Key Takeaways:

- Limited access to credit can hinder financial stability for lower-class individuals.

- Skipping payments on necessities like heat, rent, and utilities indicates financial distress.

- Struggles with educational financing can be a sign of lower-class status.

- High housing expenses contribute to financial instability and being “housing burdened.”

- Recognizing and taking action on these signs is crucial for improving financial conditions. Focus on strategies like debt management, savings, and increasing income.

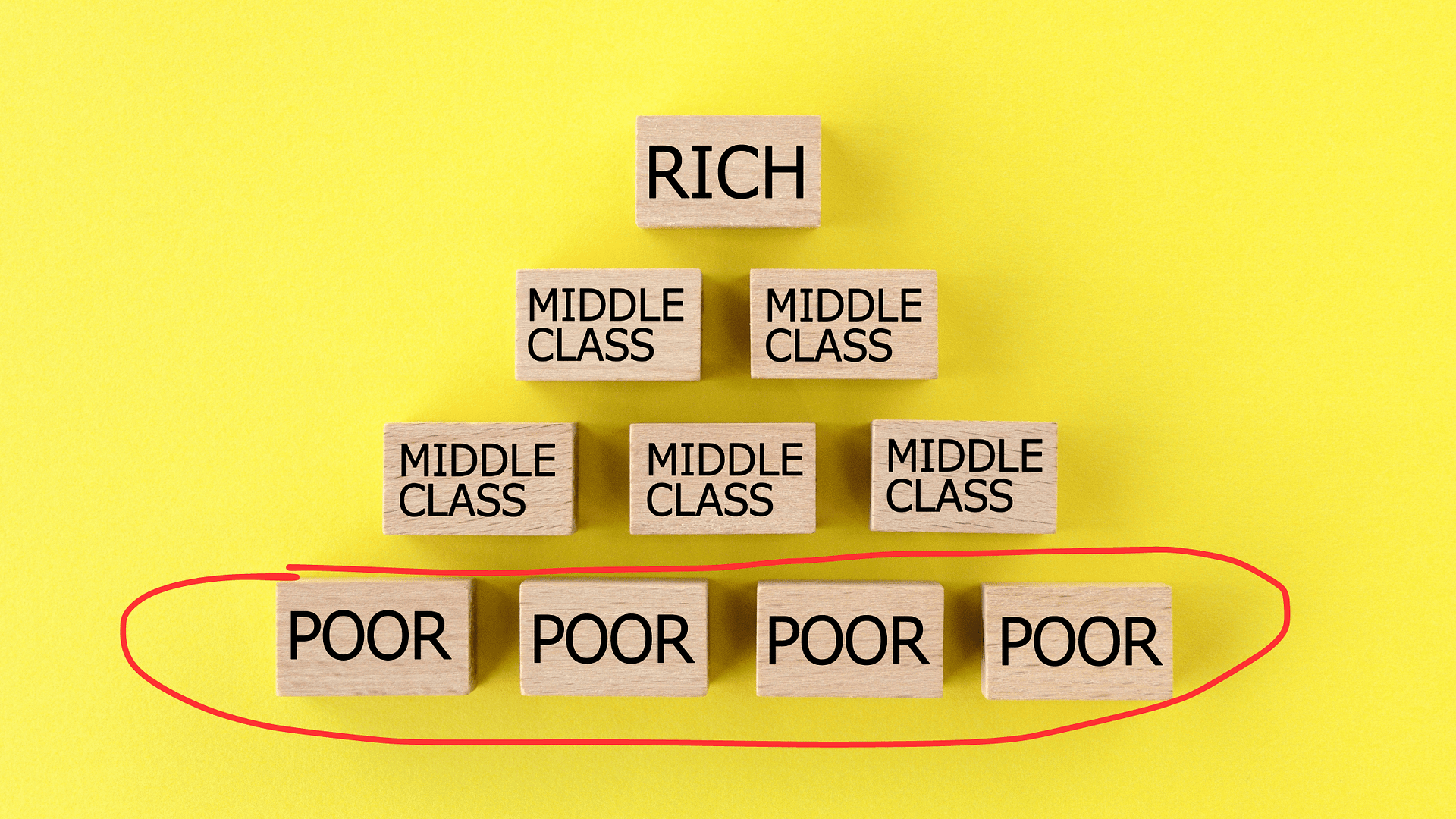

Financial well-being is a crucial aspect of life, affecting everything from our basic necessities to our long-term goals and dreams. But how do we know if we’re struggling financially or are part of the lower class in society? Here are eight signs that might indicate this:

1. Low-Income Levels

One of the most apparent indicators of being in the lower class is low income. But what does “low” mean? According to the U.S. Census Bureau, the poverty line for a family of four was $26,692 in 2020. If your household income falls below this threshold, you could be considered part of the lower class.

2. Lack of Financial Stability and Security

Feeling constantly worried about money, living paycheck to paycheck, and having no financial cushion can also signify lower-class status. Financial stability means having enough income to cover your expenses and save for the future. If you’re unable to do this, it might be a sign of financial instability.

3. No Savings or Emergency Funds

Ask yourself, do you have funds set aside for unexpected expenses like a car repair or medical bill? If the answer is no, this might indicate a lack of financial security. Emergency savings are a critical part of financial health, providing a safety net in case of unforeseen costs.

4. High Debt-to-Income Ratios

Are you spending a significant portion of your income on debt payments? A high debt-to-income ratio—where your monthly debt payments exceed 40% of your gross monthly income—can be another sign of financial struggle and lower-class status.

5. Inability to Access Credit or Loans

If you have difficulty getting approved for credit cards or loans, it could be due to a low credit score or insufficient income, both of which are common in the lower class. This inability to access credit can make it hard to cover unexpected expenses or invest in opportunities like education or homeownership.

6. Skipping Payments on Bills & Necessities

Another alarming sign is regularly skipping payments on bills and necessities like rent, heat, and utilities due to financial hardship. This pattern can lead to severe consequences, including eviction, service cut-offs, and damaged credit.

7. Falling Behind on Education Financing Loans & College Tuition Fees

Struggling to pay for education-related expenses, such as student loans or college tuition, can also indicate lower-class status. Education is often seen as a pathway out of poverty, but for many, the cost is a significant barrier.

8. Spending More than 30% of Their Income on Housing Costs

Lastly, if you’re spending more than 30% of your income on housing—whether that’s rent or mortgage—you could be considered “housing burdened.” This high expenditure leaves less money for other necessities and savings, contributing to financial instability.

Bottom Line:

Recognizing these signs is the first step towards improving your financial situation. Remember, it’s not about blame or shame; it’s about understanding your current circumstances so you can take steps towards financial stability and security. Whether through debt management, savings strategies, or income enhancement, there are ways to move up from the lower class.

How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023

How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023 How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023

How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023 How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023

How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023 How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023

How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023 How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023

How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023