Are you feeling overwhelmed by a high-interest credit card debt that is encroaching on your finances? You’re not alone. With the current state of our economy, many people are facing similar struggles, and if you can relate, it doesn’t have to be an insurmountable foe. There are a few practices you can start right away that could help reduce or even eliminate your out-of-control debt – all without breaking the bank or resorting to credit repair services. From transferring balances to finding ways to use reward points more effectively, this blog post will look into some nifty strategies for tackling high-interest debt with smarter credit card habits.

Start by evaluating your spending habits.

If you’re like most people, you probably don’t give much thought to where your money goes each month. You may just know that you need to have a certain amount of money saved up for bills and emergencies, and the rest is yours to spend as you, please. But if you want to get your finances in order, it’s important to take a closer look at where your money is going – especially if you’re not happy with the results.

One way to start evaluating your spending habits is to take a look at your bank statement from the past month. Are there any areas where you’re spending more than you’d like to? If so, try to come up with a plan to curb those expenses. Maybe you could find a less expensive alternative for your cable TV or internet service, or maybe you could start cooking more meals at home instead of eating out.

Another thing to keep in mind when evaluating your spending habits is that your needs and wants may be different from someone else’s. Just because your friend can afford to go out for dinner every night doesn’t mean that you have to do the same. It’s important to figure out what’s important to you and what you’re willing (and able) to live without.

When it comes down to it, taking charge of your finances isn’t always easy, but it’s worth it. By evaluating your spending habits and making some small changes, you can start getting your finances in order and improve your overall financial situation.

Look for opportunities to transfer high-interest balances to a card with a lower rate.

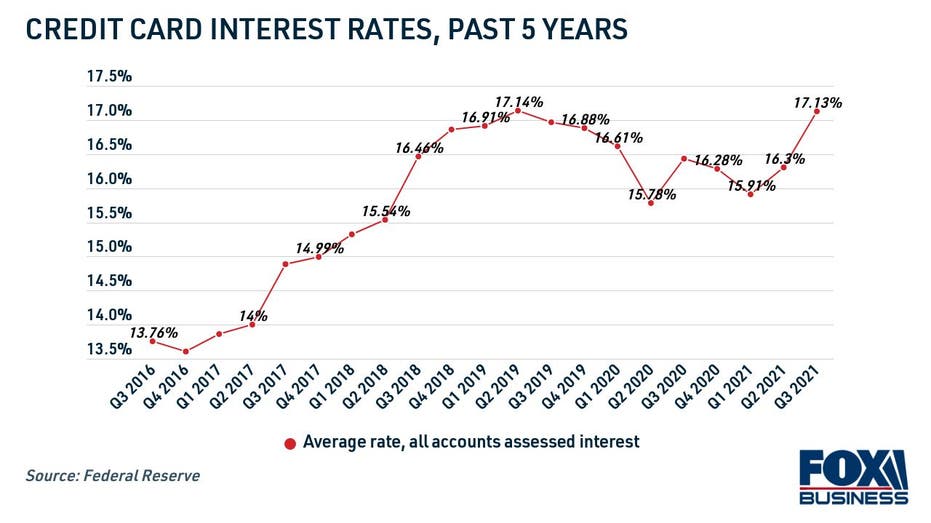

When it comes to credit cards, one of the most important things to consider is the interest rate. High-interest rates can quickly add up, costing you a lot of money in the long run. If you have a high-interest credit card balance, you may want to consider transferring it to a card with a lower rate.

There are a few different ways to do this. One option is to call your credit card company and ask them to transfer your balance to a card with a lower rate. Another option is to use a balance transfer calculator to find out which card has the lowest interest rate. This calculator can help you determine how much you’ll save by transferring your balance.

Whatever method you choose, it’s important to act fast. Many credit cards offer promotional rates for a limited time only, so you don’t want to miss out on this opportunity. By transferring your balance to a card with a lower interest rate, you can save yourself a lot of money in the long run.

Use your reward points more effectively.

Rewards points can be a great way to get free stuff, save money, or just get a little something extra. However, they can also be difficult to use effectively. Here are a few tips on how to make the most of your rewards points:

1. Make a list of what you want to use your points for. This will help you stay organized and make sure you’re using your points most effectively.

2. Look for rewards that fit your needs. Not all rewards are created equal – some may be more useful for you than others.

3. Use your points as soon as possible. Many rewards expire after a certain amount of time, so it’s important to use them as soon as possible.

4. Combine your points with other discounts or deals. If you have a lot of points, see if you can combine them with other discounts or deals to get even more value out of them.

5. Don’t let your points go to waste. If you don’t think you’ll be able to use your points within a reasonable amount of time, consider exchanging them for cash or another type of reward.

Be mindful of your credit utilization ratio.

Your credit utilization ratio is one of the most important factors when it comes to your credit score. This is simply the percentage of your total credit that you are using at any given time. So, if you have a total credit limit of $10,000 and you are using $9,000 of it, your utilization ratio is 90%. This is a high ratio and can indicate that you are struggling financially. A lower ratio is better for your credit score, so try to keep it below 30%.

There are a few ways to do this. One is to pay off your balances every month. This will ensure that you are always using a small percentage of your available credit. Another way to keep your utilization ratio low is to increase your credit limit. If you can get your creditor to raise your limit, this will bring down your overall utilization percentage. Finally, you can also try to spread out your debt across multiple cards. This will decrease the amount of debt that you are using on any one card and will help keep your utilization ratio low.

Avoid overspending and creating more debt.

When it comes to spending, it’s important to be mindful of what you’re doing. Overspending can quickly lead to more debt, and that’s the last thing anyone wants. So how can you avoid overspending?

There are a few key things to keep in mind. First, take a close look at your budget and make sure you’re not spending more than you can afford. If your spending is out of control, it’s time to make some adjustments. Second, be mindful of your triggers. If you find yourself always overspending when you go shopping, try avoiding the mall or department stores altogether. Third, think about your priorities. Are you more interested in buying things, or in enjoying experiences? When you start to think about money in terms of what it can buy you, rather than just numbers on a screen, it can be easier to reign in your spending.

Finally, remember that it’s okay to say no sometimes. If you don’t have the money for something, don’t feel like you have to go into debt just to buy it. There are plenty of other things in life that are worth enjoying without breaking the bank. By following these tips, you can start to take control of your spending and avoid overspending altogether.

If you’re looking to get your finances in order, it’s important to understand your spending habits. Take a close look at where you’re spending your money and see if there are any areas where you can cut back. Additionally, try to transfer any high-interest balances to a card with a lower rate. It’s also crucial to use your rewards points more effectively — aims to earn them and then redeem them for something valuable that will help improve your financial situation. Finally, be mindful of your credit utilization ratio and avoid overspending or creating more debt. By following these steps, you can take control of your finances and start working towards a brighter future. Read more here for additional tips on getting your finances in order.

How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023

How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023 How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023

How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023 How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023

How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023 How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023

How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023 How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023

How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023