Can you get a personal loan with a 500 credit score? What types of loans can you qualify for?

If you have bad credit, you might be wondering if it’s possible to get a loan. The good news is that there are several options available for people with poor credit. In this blog post, we’ll discuss some of the different types of loans you can qualify for with a 500 credit score. We’ll also provide helpful tips on how to improve your credit score so that you can qualify for even better loan terms in the future.

It’s possible to get a loan with a 500 credit score, but your options will be limited

A personal bad credit loan might be exactly what someone with a 500 credit score needs to get back on financial footing. While it’s true that there are limited options available, many lenders provide loans for bad credit and personal bad credit loans that could help improve the overall financial situation of those with poor credit scores. With diligence and patience, often all it takes is time to build better credit history. The process can be difficult, but having a personal bad credit loan can provide some much-needed financial cushion while allowing you to raise your credit score over time.

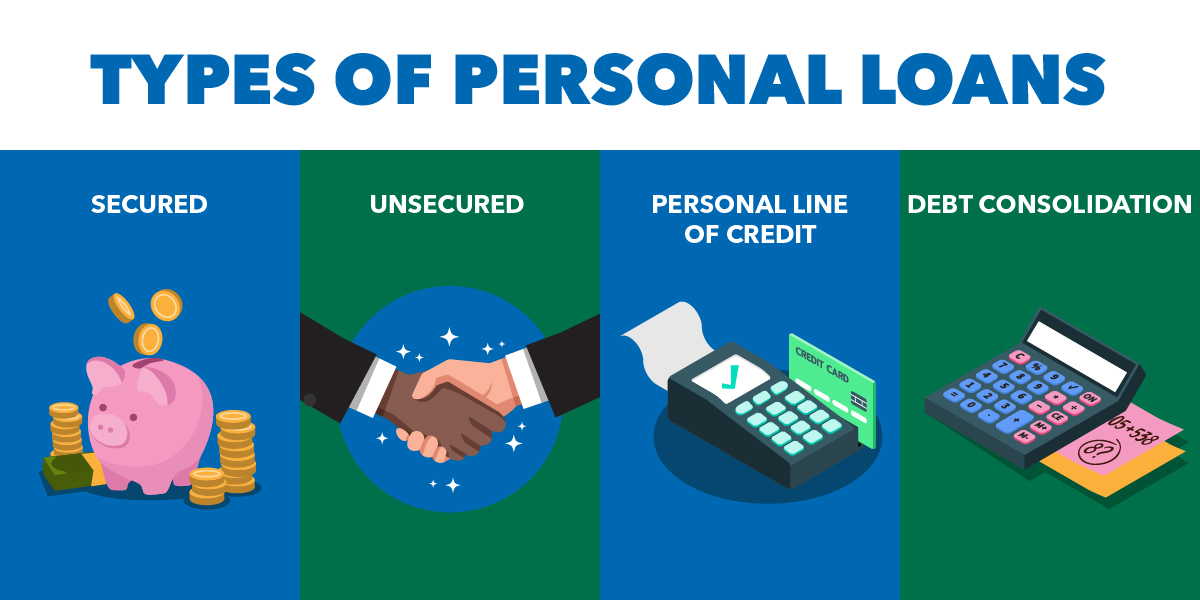

Personal loans can provide a great way to improve or repair your credit score. A personal loan is a type of unsecured loan that does not involve collateral, meaning you don’t need an asset such as a car or house to get approval for the loan. They are also known as signature loans and are designed for those who need money quickly.

When it comes to types of personal loans, there are several options available depending on your needs. For example, if you have immediate needs such as medical bills or debt consolidation, then short-term personal loans may be best for you. These often come with higher interest rates and monthly payments but can give you the funds you need right away.

On the other hand, if you have more long-term goals in mind, then longer-term personal loans may be better suited for your needs. These typically come with lower interest rates, lower monthly payments, and flexible payment plans, so they can help you save money over time while still accommodating sudden expenses that may arise during repayment.

No matter what type of personal loan you choose, proper financial management is key to success with these kinds of personal loans. You should always make sure that you understand the terms of your personal loan before signing any contract and be mindful of how the payments will affect your budget going forward. Additionally, it’s important to stay on top of monthly payments and make sure that any extra payments are applied towards principal rather than interest. Doing so could help reduce the overall cost of borrowing in the long run and help improve your credit scores.

Don’t give up hope if you have a bad credit score – there are still loan options available that could help put you back on the path toward good financial health.

It is possible to qualify for a bad credit loan even with a low credit score.

However, due to the increased risk that lenders face in providing most personal loans, the interest rates associated with them tend to be significantly higher than those offered on conventional loans. This is because when offering poor credit loans, lenders are taking on a greater risk of not being able to get repaid in full. When applying for a poor credit loan, it’s important to understand that lenders use your credit score and credit report as an indicator of how likely you are to repay the loan and make timely payments.

If you have a poor credit score, it may indicate to lenders that you have had difficulty managing debt or making payments on time in the past. As such, they will often charge higher rates of interest to offset this risk. Despite the higher interest rates associated with poor credit loans, there are still ways to save money when taking out this type of loan. For example, by shopping around and comparing different lenders’ terms and conditions, you may be able to find one that offers lower interest rates than others. Additionally, some lenders may offer special promotions or discounts which could further reduce the cost of borrowing for those with poor credit scores.

Furthermore, if you can demonstrate responsible financial management and make timely payments on your bad credit loan over the repayment plan, this may help improve your overall credit rating and could potentially lead to lower interest rates in future borrowing scenarios. In addition to searching for better terms through comparison shopping and making prompt payments on your existing bad credit loan(s), there are many other steps individuals can take to boost their overall credit score and secure more favorable terms from lenders in future borrowing scenarios. For instance, creating a budget and tracking spending can help manage finances more effectively; reducing existing debt gradually over time also helps reduce overall debt to income ratio; maintaining positive payment histories by paying all bills on time will slowly but surely increase one’s FICO score; and finally avoiding high-risk behaviors like late payments or maxing out available lines of credit can go far towards restoring good standing within creditor communities.

If you have collateral, such as a car or home, you may be able to get a secured personal loan

Secured personal loans are a type of personal loan where an asset, such as a car or house, is used as collateral to secure the personal loan. This means that if you default on the loan, your asset can be taken by the lender to make up for their losses. These personal loans tend to have lower interest rates than unsecured loans since there is less risk involved for lenders. Additionally, secured personal loans may also have higher borrowing limits and longer repayment terms than other types of personal loans.

The pros of taking out a secured loan include lower interest rates and better borrowing limits than those offered by unsecured loans. Furthermore, you may be able to negotiate a more flexible repayment plan with your lender since they’re likely to view you as a lower-risk borrower. A secured loan can also help build your credit score over time if you make timely payments on it, which could potentially lead to more favorable lending terms in the future.

However, taking out a secured personal loan also comes with some risks. If you fail to make regular payments on the personal loan or default completely on it, your asset can be seized by the lender to recoup their losses. This means that if you cannot keep up with making payments on your loan, then you could end up losing whatever item was used as collateral against it – so it’s important to stay mindful of this potential risk when considering taking out a secured personal loan. Additionally, some lenders may require additional collateral beyond just the item being used for the loan (i.e., your paycheck or car title) – so make sure that you know all of the requirements before signing any contract and understand what actions will be taken if you default on payments.

Payday loans are another type of short-term financing product that typically uses assets like your car title or job payment as collateral against them to secure the loan agreement and mitigate risk for lenders offering them. With payday loans however, there is usually a much shorter repayment period (often two weeks) and higher interest rates associated with these types of products due to their high-risk nature – so should only be considered if necessary and repaid quickly upon receipt of funds!

Most lenders will offer secured personal loans – whether they be payday lenders or traditional financial institutions – providing that they are satisfied with the asset being offered and its value relative to what’s being borrowed against it i.e., most often cars or homes are used but depending on circumstances other items such as jewelry or electronics can also serve as forms of collateral too! Ultimately though before taking out any kind of secured personal loan, borrowers should carefully consider all options available before making any decisions and make sure that they fully understand all possible risks involved before agreeing to anything in writing!

Work on improving your credit scores to help improve your odds with personal loan lenders

Lenders will take a close look at your credit history and scores when it comes to securing a loan. Typically, personal loan lenders will require that you have at least a good credit score, which is generally defined as above 670 on the FICO scale. A higher credit score can improve your chances of obtaining better terms with lower interest rates and longer repayment periods. Your credit history will also be taken into account to determine the amount you can borrow and the repayment schedule for your personal loan.

If you have negative items in your credit reports such as late payments or too many open lines of credit, then this could reduce your chances of being approved for a persoloan or getting more favorable repayment terms. Creditors may consider these items when evaluating whether or not to lend money. To increase your odds of obtaining better loan terms, it’s important to work on restoring good standing on your credit history by avoiding high-risk behaviors such as maxing out available lines of credit or making late payments on existing loans.

You also need to understand how lenders view “riskier” borrowers and why they might offer higher interest rates or shorter repayment periods. Riskier borrowers are those who have fewer assets, lower incomes, and/or bad credit histories that make them look less likely to pay back their personal loan in full. They may also be charged higher fees if they miss any payments or fail to make all their monthly payments on time.

As such, it is important for anyone looking to take out a personal loan to ensure that they are well aware of their financial responsibilities and ability to pay back their debt before agreeing to any contracts or repayment plans with lenders. Understanding the specific requirements of each lender, such as minimum income levels, acceptable forms of collateral (if applicable), fees associated with missed payments, etc., can help you select a lender that offers terms most suitable for your particular circumstances so you don’t get stuck paying unexpectedly high-interest rates or having difficulty making repayments due to other obligations taking up too much of your monthly budget!

Debt consolidation loans for bad credit

Debt consolidation personal loans are often a popular choice for individuals with bad credit who are looking to consolidate their existing debt into one, single loan. This type of loan can be beneficial in that it may offer lower interest rates and/or more flexible repayment terms than what is available through traditional lenders. However, borrowers will still need to have a minimum credit score requirement in order to qualify for the loan.

The exact minimum credit score needed for debt consolidation personal loans will vary depending on the lender. Generally speaking, those with higher credit scores will have better chances of getting approved for a loan—although there may be certain circumstances where lenders may consider applicants with lower scores as well. Additionally, lenders may also require additional documents such as proof of income to assess a borrower’s ability to repay the debt consolidation loan.

For those seeking debt consolidation personal loans, it’s important to understand how their credit score can impact their ability to obtain financing. Poor or fair credit scores may result in higher interest rates or even disqualification from certain types of personal loans altogether. The good news is that there are ways to improve your credit score and make yourself more attractive to potential lenders—such as by making timely payments on your bills and reducing overall outstanding balances each month.

It’s also important to remember that when applying for debt consolidation personal loans, you should always shop around and compare offers from different lenders before signing any contracts or agreements. Doing so can help ensure you get the best deal possible—both in terms of APRs (annual percentage rates) and other associated fees—so that consolidating your existing debts becomes a much smoother process over time!

Origination fees with bad credit score personal loan lenders and online lenders

When considering origination fees with bad credit personal loans, it is important to understand the difference between traditional personal loan lenders and credit unions. Traditional lenders, such as banks, often require higher origination fees than credit unions, which can be especially problematic for those with bad credit who are already paying higher interest rates on their personal loans. The origination fee is a one-time fee charged by the lender at the start of the personal loan process and covers expenses associated with processing the personal loan or preparing the paperwork needed for closing on the personal loan.

The amount of an origination fee can vary greatly depending on the type of personal loan and lender you choose. For example, some traditional lenders may charge up to 5% of your total personal oan amount in addition to other fees like appraisal and underwriting costs. Credit unions typically have lower origination fees than traditional banks; however, these fees can still be significant if you are taking out a larger personal loan. It is always important when signing a loan agreement to make sure that you understand all associated costs involved in taking out any type of personal loan.

It is also important to remember that if you are taking out a bad credit personal loan from either a bank or credit union, then there may also be additional fees beyond just the origination cost. Credit unions generally have more flexible repayment terms than traditional banks which can give borrowers with bad credit more options. However, they may also require additional charges such as late payment or prepayment penalties to help offset their risk when lending money to someone with spotty credit history.

No matter what type of lender you choose for your bad credit personal loans, it is essential to carefully read through all documents associated with your agreement before signing anything so that you can ensure you fully understand all associated costs involved with your new debt obligation. Knowing what types of additional expenses may arise will help keep you informed throughout the entire borrowing process and allow you to budget accordingly so that repaying your debt remains manageable over time!

Another option is payday loans vs bad credit personal loans

Payday loans are often seen as a last resort for those with bad credit who are looking for personal loans and unable to find funding from traditional lenders. They are short-term personal loans that can be used to cover immediate or unexpected expenses, such as rent, car payments, medical bills, or other one-time costs. These personal loans generally have very high-interest rates and are typically due within two weeks, although some lenders may offer longer terms.

For those with bad credit who already face higher interest rates on personal loans from traditional banks, payday loan lenders may seem like an attractive option; however, the cost of taking out a payday loan can be extremely high due to the high-interest rates associated with them. For example, if you borrow $700 at a 15% APR (annual percentage rate), you would owe around $850 when the loan is due at the end of two weeks—that’s more than 20% of your original loan amount!

Additionally, many payday loan lenders require borrowers to provide access to their bank account or submit postdated checks that will be cashed upon repayment of the personal loan. This makes it much easier for lenders to collect on unpaid debts and increases their chances of receiving full payment promptly. Furthermore, if you fail to repay your payday loan on time (or at all), your lender may use aggressive tactics such as threatening legal action or reporting missed payments to credit bureaus—which could further damage your already low credit score.

For these reasons and more, it’s important for consumers with bad credit who are considering taking out a payday loan to understand the risks associated with doing so before signing any documents or agreeing to any contracts. It’s also recommended that individuals research different types of personal loans available which may offer better terms than what is available through payday lenders—such as longer repayment periods and lower interest rates—and explore other options such as government assistance programs or family/friend support before committing themselves financially. Doing so could save them money in the long run!

You can also try borrowing from friends or family, or using a credit card for financing

If a secured or unsecured personal loans application has led to denials and it’s an urgent matter, borrowing from friends or family or using a credit card for financing may be an option. Borrowing from friends and family can provide you with the cash you need quickly, and can often come with more flexible repayment terms than what is available from traditional institutions. However, this option can also have its own set of risks. For example, if you are unable to repay the loan given to you by a friend or family member, not only will they not receive their money back but your relationship with them could also take a hit as well.

Using a credit card for financing can also be an option in some situations. Credit cards typically offer much lower interest rates than many other types of loans, as well as flexibility in payment terms and rewards programs. Additionally, it’s easier to qualify for a credit card than it is for most types of loans since they don’t typically require collateral or extensive financial documents like bank statements and proof of income. But while using a credit card may seem like a straightforward solution to your urgent financial needs, be aware that this option comes with its own set of risks – namely high-interest rates if payments aren’t made in time and penalties for missed payments that can add up quickly. So before deciding on this route, make sure to consider all costs associated with it before committing to any contracts!

In either case – whether borrowing from friends and family or using a credit card – it’s important to understand the responsibility that comes along with taking on more debt when trying to get out of an urgent financial situation. Make sure that you can meet the conditions outlined by whoever is providing the funds – including timely repayment plans – so that long-term damage isn’t done to relationships (in the case of friends/family) or your credit score (when using a credit card). And don’t forget about making room in your budget afterward so that you can pay off accrued debt as soon as possible!

Whatever option you choose, make sure you do your research and understand the terms of the loan before signing anything

When it comes to making financial decisions, there’s no room for being unprepared. Whether you’re choosing a loan for your business, auto financing, or a personal loan, doing research and reading the fine print is essential. You don’t want to be blindsided by additional fees or stakes you didn’t anticipate. When feeling overwhelmed, take deep breaths and use the internet as a wealth of knowledge to learn more and weigh your options. Keeping track of the different terms and understanding what you’re signing up for can help minimize risk and increases the chances of success with whatever goal you’re looking to accomplish. Make sure you do your research before signing anything!

Borrowing money can be a complicated process, but with the right research, you can find a loan option that meets your needs. Whether it’s a bank loan, bad credit loan, secured loan, or other financing option, make sure to ask questions and understand the terms of the loan before signing anything. It may take some time to find the best repayment plan for you, but if you take the time to do your research and shop around for the best rates, you will be able to secure a personal loan that fits into your budget and helps you achieve your financial goals. It may be intimidating at first, but with patience and perseverance, you’ll have no problem finding an appropriate loan that can help get you back on track financially.

How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023

How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023 How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023

How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023 How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023

How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023 How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023

How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023 How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023

How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023