The borrower’s creditworthiness, for instance, the ability to repay his financial obligations within the prescribed period, is the most critical factor assessed by the bank when considering a loan application. Based on the reliable financial standing, financial institutions also determine the maximum amount for which the customer can take out a loan. For those reasons, it is essential to understand what credit is, how it works, and what contributes to your bad credit scoring before proceeding to repair credit utilizing a credit repair company’s professional services.

Credit – History, Concepts, Types of Credit

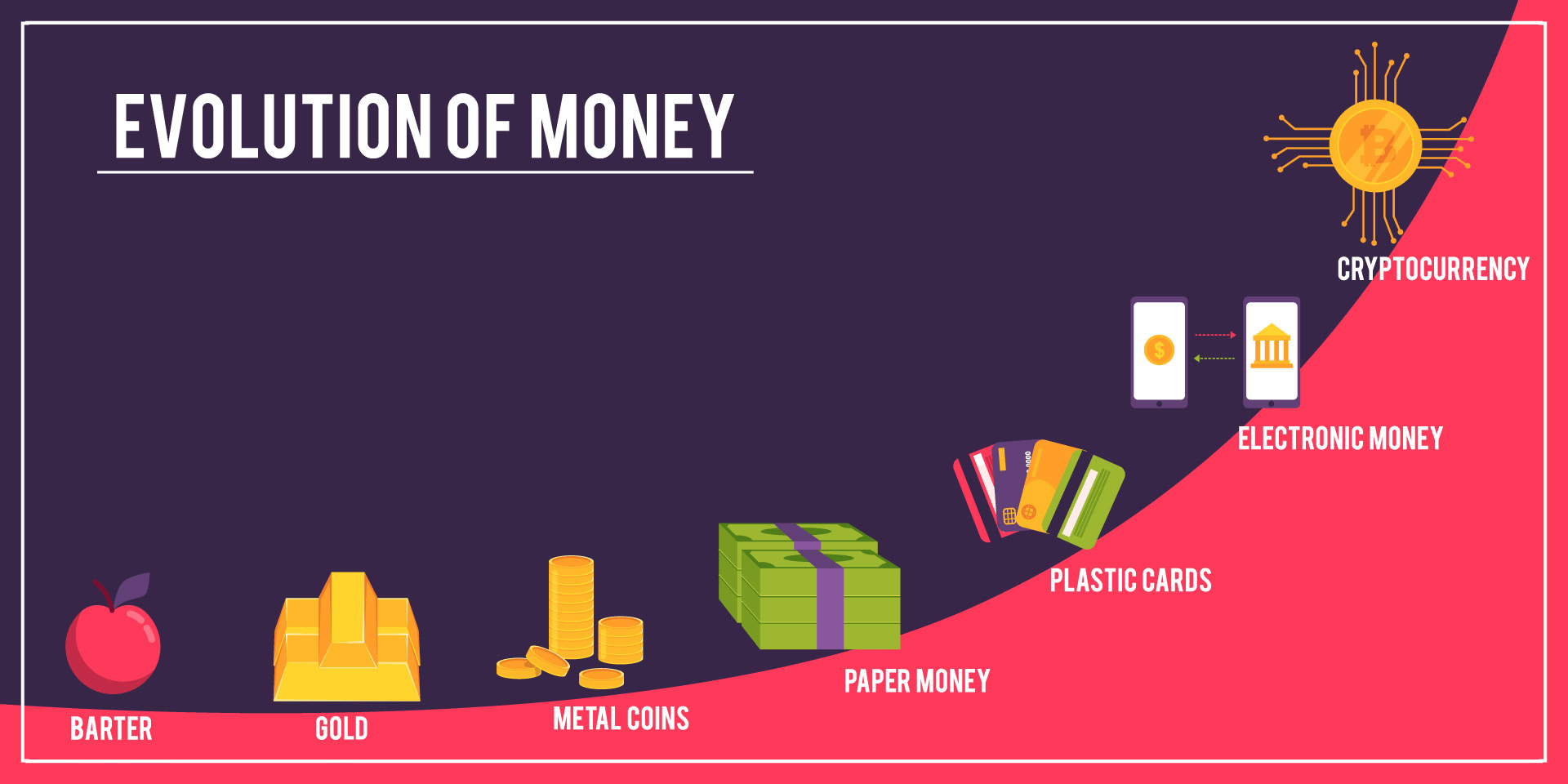

The word credit comes from the Latin language – credere – and means to trust or believe. The very history of credit is inextricably linked with the development of money as a means of payment, the roots of which go back to antiquity. It all started with the Phoenicians, the ancient merchant people of the Mediterranean. They were the first to introduce coins to use. The oldest of those found by archaeologists date back to the 7th century BC.

The invention of coins made it possible to replace the original form of money, which were consumer products such as spices or metals in the form of ore, which in turn washed away the previously practiced barter (barter trade). The unification of the measures and weights of ore, which was allowed by the production of coins, became a milestone in the development of purchase and sale transactions. Thus, the emergence of banking systems and the popularization of loans as a form of borrowing money.

The times of the most significant development of banking and loans fell on the period of the 17th – 19th centuries when newly emerging banks supported the rapidly developing trade with Asian countries and the subsequent industrial revolution with favorable loans.

Today, a loan is an agreement concluded between a bank and a borrower. Under it, the bank provides the borrower with a specific amount, which he undertakes to allocate for a predetermined purpose. In addition, the borrower undertakes to return the amount borrowed together with the accrued interest, commission for granting the loan, and other additional fees within the prescribed period. The loan repayment is usually made in monthly installments, and the loan repayment period may vary from several months to even several dozen years. The loan agreement must be in writing.

Today, loans are fully formalized contracts for borrowing money for a specified period and returning them with pre-determined interest. The development of banking and entrepreneurship has led to the separation of many types of loans, such as:

- a cash loan

- mortgage

- consolidation loan

They differ in the form of security, the conditions of granting a loan, as well as the amount of interest.

Every adult citizen has the right to apply for a loan, which is not equivalent to receiving it. The procedure for obtaining a bank loan is often complicated and time-consuming; it requires submitting a loan application and completing a number of formalities. The bank then analyzes the applicant’s creditworthiness and, on this basis, grants or refuses to grant a loan.

Companies and institutions can also apply for a loan. They can count on the following types of loans:

- A short-term loan in the current account,

- overdraft,

- revolving loan,

- investment loan.

The Dreadful “Bad Credit”

Bad credit history can cause us a lot of trouble when we want to take advantage of the loan offer of most financial institutions. There can be many reasons why our credit score has dropped, but the most contributing factor is an untimely repayment of our previous obligations. Sometimes it is a past loan and other times rent arrears or an unpaid credit card debt. No matter what caused our credit history to be bad, everyone is striving to improve it. Is there anything we can do to correct our credit and enjoy the opportunities it provides?

Where do banks get information about customers?

Before applying for a loan from a bank or other financial institution, it is essential to understand what credit bureaus are and how they operate. There are three major credit bureaus in the United States, which collect information on all our debts: Equifax, TransUnion, and Experian. The report, negative and positive, is provided to their databases by the banks themselves as well as all other financial institutions and loan providers. Therefore, it contains information on our debts and unpaid bills and invoices with which we are in default. What’s more, data is collected for both individual customers and companies.

When we apply for a loan from a bank or another loan company, not only the sources of our income will be checked, but also our credit report. Thanks to it, a specific financial institution can check our credit history, on the basis of which it determines whether we are a reliable borrower. After all, none of them want to take risks by lending money to a person who has had problems paying off their liabilities in the past. Therefore, if we are aware that our credit history is not in its best standing, we will probably look for a way to repair it.

Is it possible to remove negative information from your credit history?

When we know that our credit history is inadequate, yet we want to receive another loan, we begin to wonder if there is a way to correct past mistakes. The first thought that comes to mind is that there is definitely a way to modify negative debt history. And by the word “modify,” we understand that it is possible to remove individual data from the credit bureau report submitted to financial institutions. But unfortunately, in practice, it is impossible to do without concrete motive. The data stored by credit bureaus are only administered by their systems, which may happen to be faulty. The possible dispute of negative entries in our credit report, however, is subject to banking law.

If something went wrong during the repayment of any of our obligations, unfortunately, we have to take into account that banks and loan companies will have access to information on this subject for approximately seven years. Of course, the modification of individual data is possible, but these are precisely defined cases in which the submission of appropriate applications is also required.

Which Credit Report Errors Can You Dispute?

According to the information provided to consumers by credit bureaus, there are a few situations in which it is possible to change or altogether remove data from our credit report. This can happen when:

- Negative credit report entries are older than seven years;

- Inaccurate information on your credit report;

- Incomplete information on your credit report;

- Information that cannot be verified;

- Payments mistakenly reported late that were paid on time;

- Accounts that do not belong to you;

- Inaccurate lender;

- Incorrect loan amount, limit, or balance

- Erroneous account status.

Requests for any changes to such reports must be submitted by clients or credit repair companies to the financial institution that provided information on their debt to credit bureaus. After analyzing it, the letter must be prepared with appropriate justification so that the credit bureau can modify the data about a specific person, which brings us to the main topic of this article – credit repair companies and how to choose the one that works.

How Do Credit Repair Companies Work?

Since we have already verified that dispute of charges may be possible with the appropriate level of patience and determination, we also concluded that indeed credit repair companies, as long as they have a reliable and distinguished reputation, do work.

Credit repair, a third-party organization, makes attempts on your behalf to remove negative, inaccurate, and impactful information from your credit report. At the federal level, credit repair is a legal service provided in exchange for a fee, most often paid monthly by their customers. A reputable credit repair company follows the guidelines established by the federal Credit Repair Organizations Act, which prompts these organizations to act in accordance with current law and standards for ethical and legal reasons. In order to remain compliant with federal law, credit repair companies must abide by the following rules:

- Credit repair companies cannot report, or advise customers to report, inaccurate information to credit bureaus;

- Credit repair companies are not allowed to suggest the change of their customers’ identification of any form;

- Credit repair companies are forbidden to charge for services that have not been fulfilled;

- Credit repair companies cannot make false statements or promises, such as guaranteeing the removal of negative entries from their customers’ credit reports;

- Credit repair organizations must provide truthful and accurate information to their customers, such as understanding the dispute process. Their clients must be informed that they have a full right to dispute their own charges for free;

- Customers have a right to sue the credit repair company if any of the points within the CROA have been violated;

- Credit repair companies are required to inform their customers that mistakes may occur by credit reporting agencies.

How Long Does The Credit Repair Process Take?

When deciding to repair credit history and raise the credit score, we often wonder about the timeline and how long it will take for us to finally buy the new house or needed equipment. We want our history to become positive in the blink of an eye, and we want the banks to grant us a loan on the best terms without any problems. Is it possible, or do we have to wait longer and make more effort to increase credit scoring and use banking and financial services available on the market again?

It is worth noting that the deadline on which a full credit history repair can be accomplished may vary depending on the specific case and many other factors. Before using professional repair for the first time, the client receives an action plan that must be followed in order to regain creditworthiness and increase his credit scoring.

The length of the credit repair procedure may vary depending on the individual circumstances of each borrower. In some cases, it may take from one to several years, and in others, it can be completed within a few weeks. Several key factors determine how much effort you will put in to become a desired customer of banking and lending institutions again. The following factors affect the timing of the repair of your credit:

- number of current debts;

- past due number of liabilities;

- type of financial liabilities that the client had/has;

- overall assessment of the customer’s borrowing experience;

- number of successfully contracted and returned credits and loans;

- the number of rejected loans or loan applications.

Please note that there is no standard time limit for credit repair. Most often, the entire process and its effects depend on the individual situation of a particular borrower, his previous experience, and even the approach to repairing the credit history. Sometimes a comprehensive approach to improving credit and raising credit score is required. At other times, even one positive entry in the credit report about a loan taken and returned before the deadline is enough to be still able to use the loan services fully.

Is Credit Repair Effective?

Professional credit history repair is useful in every case: both when the customer has a very bad history and when the record has been corrupted by only one or more negative entries. Nevertheless – both in the first and in the second case – it is not worth counting on an immediate effect. As we mentioned earlier, this is a long-term process that sometimes requires more patience, time, and effort.

In addition, most customers who decided to use the professional credit history repair services noted that in their case, this solution was very effective and ultimately resulted in the possibility of taking out a bank loan or mortgage.

How To Build a Satisfactory Credit History?

Building a positive credit history is undoubtedly time-consuming and requires some effort from us. Is it worth it? In the long run, – yes! Why? Because it makes us credible in the eyes of the bank, which is invaluable when incurring new financial obligations. A positive history with credit bureaus not only allows you to take out a loan but also increases your chances of getting it on good terms.

In turn, bad credit history or the complete lack of one can mean the following problems:

- The bank will increase your loan margin or interest rates;

- You will have to pay a higher commission;

- You will receive a loan for a shorter period or a lower amount than initially wanted;

- In extreme cases, the bank may even refuse to grant us a loan or credit.

To begin the journey of building a credit history, start with a credit card. Many people shy away from credit cards, considering it an unnecessary burden and a path to financial trouble. However, it does not have to be this way if the credit card limit is wisely and responsibly managed.

It is worth getting in the habit of using the card regularly, with everyday purchases. Thanks to interest-free periods and rebate programs, we can get many discounts on purchases, fuel, or visits to restaurants. However, you must remember to pay off the card within the time limit specified by the bank. Regular debt repayment is enough to build a positive credit history. Nevertheless, it is crucial that you follow the thirty percent rule, utilizing only that amount of your credit card limit and paying it back in a timely manner.

Take small loans and buy using installments.

Loans taken out at the bank for various purposes are also outstanding for building a positive history with credit bureaus. You can spend the money on buying a new car, furniture, or vacation trips. After that, it is enough to pay the installments regularly. Using this method, you are on your way to becoming a reliable consumer – bank’s worthy partner.

It is also good to buy in installments from time to time – household appliances, game consoles, TV, or other desired or needed items. Most stores spread the cost into low-interest installments or interest-free repayments lasting a specific period of time. It is worth paying them off regularly and, for example, settling the entire debt in the middle of the settlement period. It is a signal for the bank that you are timely and reliable, and that you want to pay off your liabilities faster. However, be careful not to get indebted when buying consumer goods, which may lead to significant financial troubles.

Conclusion

As outlined in the article, credit management is a complex process requiring substantial financial wisdom and responsible handling of your fiscal affairs. Mistakes happen, and while mismanaged financial incidents may make you feel miserable and prevent you from pursuing your dreams at the time, there is always a proper solution to the problem when taking appropriate action and measures. And while you may make attempts at repairing your own credit, it is a perplexing process that requires a considerable amount of time, effort, patience, and determination. Reputable credit repair companies provide those legal services in exchange for an affordable fee, often with a complimentary financial education to prevent future oversights.

How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023

How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023 How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023

How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023 How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023

How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023 How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023

How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023 How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023

How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023