Are you a homeowner with good credit? You may already be aware that the Biden Administration is implementing new mortgage rules on May 1, 2023. These new Biden rules are intended to reduce risks for lenders in the mortgage industry, but they might end up costing homeowners like you more money each month. If you have a credit score of 680 or higher and a 100,000 loan balance—or if this applies to someone you know — you should read this blog post carefully to understand what these changes mean for your budgeting decisions.

Changes to Loan-Level Price Adjustments

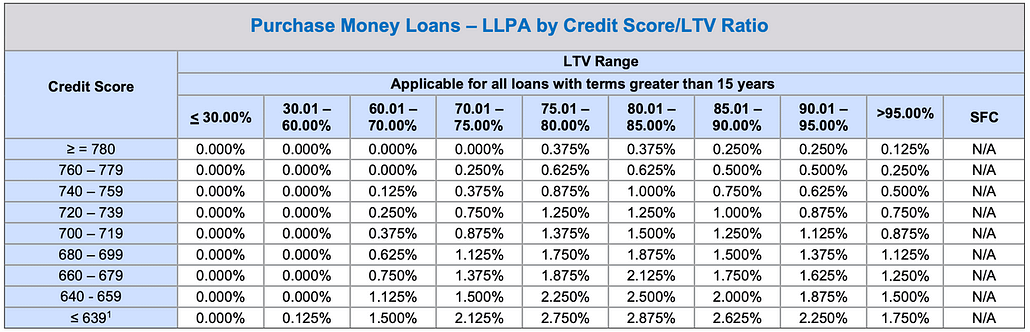

On May 1, 2023, private banks nationwide will experience a shift in mortgage rates due to changes being made by Fannie Mae and Freddie Mac. The difference lies within loan-level price adjustments – or LLPAs – which are used as upfront fees. These fluctuating percentage points rely on the buyer’s credit score and down payment size for determining the final rate of their home purchase.

Higher Costs for High-Credit Buyers

Homebuyers on the higher end of credit scores may soon see a jump in their mortgage costs due to new regulations. Those putting down between 15%-20% as an initial payment will feel the biggest brunt of this fee, with it increasing at roughly 0.25 percentage points for each rate applied long-term. Fannie Mae and Freddie Mac have implemented these changes to reduce the amount of risk taken on by lenders.

For buyers with a credit score of 680 or higher, this could mean an increase in monthly mortgage payments that range anywhere from – depending on how large their loan is. Those who can afford it should consider putting 20% down upfront to reduce their loan-level price adjustment.

Meanwhile, Lower Fees for Riskier Credit Backgrounds

Homebuyers with less-than-stellar credit scores can now reap the rewards of lower mortgage rates. Fee reductions provide a much-needed boost, making it easier to achieve homeownership goals. Those with a credit score of between 500-680 will experience the biggest decrease in loan-level price adjustments – 0.75 percentage points lower than before when their down payment is 20%.

The Biden rule seeks to make homeownership dreams more achievable for those with less-than-ideal credit ratings. And while it may also lead to higher costs for buyers with good credit, understanding the new regulations are a key step in making well-informed financing decisions.

Controversial Addition of a New Charge

Despite opposition, the Federal Housing Finance Agency (FHFA) was still determined to implement a new charge for buyers with debt-to-income ratios over 40%. Fortunately, amid mounting pressure from industry groups, they relented and agreed to delay its rollout until August.

In the meantime, borrowers should start gathering their financial information and plan for these changes. Being prepared can make all the difference when it comes time to pick a lender and calculate your mortgage payments.

Timing of Rule Changes for the Mortgage Industry

The Federal Housing Finance Agency is showing its commitment to increasing affordability amongst first-time buyers, low-income borrowers, and applicants from underserved communities with updated fee structure changes that are set to take effect on May 1st. Additional efforts by FHFA will make owning a home easier than ever for those in the previously mentioned groups of mission borrowers.

The May 1 deadline is quickly approaching, and everyone must take the time to understand exactly what these changes mean for their future home purchase. The rules set out by Fannie Mae and Freddie Mac will have a direct impact on mortgage payments and loan-level price adjustments, so take the time to research your options.

Impact on Mortgage Payments and Industry Reaction

With the US Federal Housing Finance Agency attempting to address housing affordability, new changes are being made that many industry professionals predict will mean more costly mortgage payments for homebuyers. This could potentially add extra strain on a sector of buyers already struggling with an ongoing downturn in the real estate market – leaving Pete Mills, Senior Vice President of Residential Policy at The Mortgage Bankers Association stating: “The timing of this is troubling”. On top of higher monthly expenses, these modifications may make it increasingly difficult for prospective purchasers to navigate through their application process as springtime approaches.

Though controversial, the Biden rule seeks to reduce lending risk and increase access to homeownership opportunities. For those willing to explore their options, understanding these regulations can make all the difference when it comes time to apply for a loan. Whether you’re looking to buy now or in the future, familiarizing yourself with these changes is essential so you can make the best financial decision for your situation.

FHFA Response

The FHFA is dedicated to making sure that mortgage lenders, such as Fannie Mae and Freddie Mac, can serve all loan buyers regardless of their credit score. This commitment comes despite widespread concern that has been voiced by many regarding the potential negative impacts these changes might have on high-credit buyers. When asked about this issue an official commented that long-term mortgage rates play a much larger role in determining finance conditions than shifts brought around through policy reform.

The changes to mortgage lending standards by Fannie Mae and Freddie Mac could have a disproportionate effect on minority borrowers and those with lower incomes. A study from the Urban Institute revealed that individuals who fall into these categories are much more likely than other applicants to have debt-to-income ratios over 45%. As such, they may be shut out of opportunities for homeownership due to tighter regulations in this area.

The FHFA has made strides to make mortgages more accessible by offering updates that could allow borrowers with non-traditional income, such as freelancers and ride-share drivers, to qualify. While the changes are still being discussed – feedback from stakeholders and market conditions will play a role in any final decisions – they provide an encouraging outlook towards borrowing possibilities for those who work beyond nine-to-five jobs.

As the housing market continues to recover, changes made to Fannie Mae and Freddie Mac’s lending standards are sure to affect numerous individuals seeking homeownership. While some experts view these revisions as essential for stability in the mortgage market, others worry they might make it difficult for certain groups of borrowers with lower credit scores or debt-to-income ratios. The results remain uncertain until put into practice; however, both proponents and opponents will be watching closely whether these amendments end up aiding or hampering America’s progress towards a healthier real estate landscape overall. For individuals with lower credit scores or who are struggling with debt, seeking credit repair services may be a helpful step in improving their chances of qualifying for a mortgage under the revised lending standards.

How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023

How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023 How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023

How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023 How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023

How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023 How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023

How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023 How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023

How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023