Understanding credit scores are important as they impact our financial lives greatly. Financial institutions, lenders, and credit card companies use credit scores to evaluate creditworthiness and determine interest rates, terms, and credit limits. Asking for reduced credit card limits is an action that can negatively affect your credit scores. This article will explain why this happens and provide tips on maintaining good credit scores.

Understanding Credit Utilization

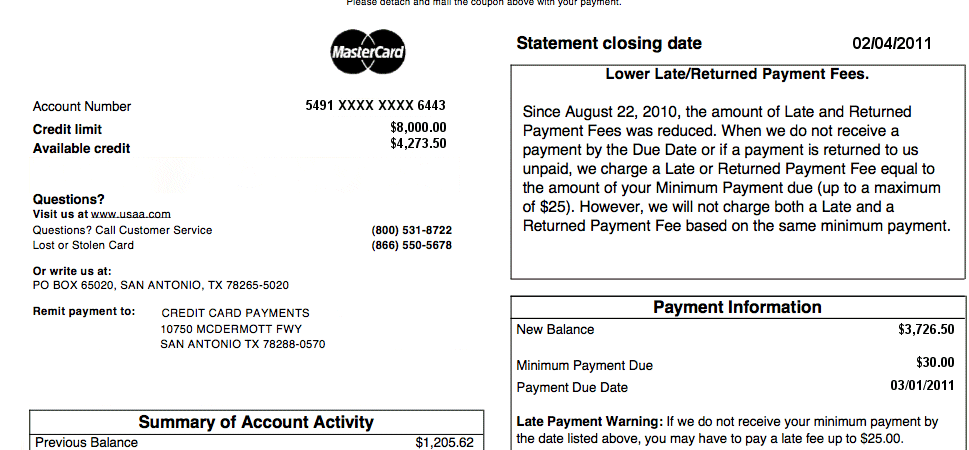

To grasp why requesting a decrease in your credit card limits may harm your credit scores, it’s necessary to comprehend what credit utilization means. Credit utilization refers to the percentage of your credit availability that is currently being utilized. For instance, if your credit card has a maximum limit of $10,000 and you have used $2,000, then your credit utilization is 20%.

Your credit score depends on how much of your available credit you’re currently using. This applies to all of your accounts and each account individually. Keeping your credit utilization low is recommended since it suggests that you’re managing your credit wisely and not depending heavily on borrowed money.

Why Lower Credit Limits Can Hurt Your Credit Scores

If you request lower credit card limits, it can raise your credit utilization by decreasing your available credit. For example, if you possess two credit cards which allow for a total of ,000 credit limit and your outstanding balance is ,000, then your credit utilization is 10%, which is considered advantageous for your credit scores. However, if you ask both credit card companies to reduce your credit limits to $5,000 each, then your total credit limit will become $10,000, leading to your credit utilization rising to 20%, which is not as beneficial for your credit scores.

Lower credit limits can harm your credit scores because they shrink your available credit but don’t lower your balances. As a result, it could look like you’re utilizing a larger portion of your credit than before, even if your spending hasn’t increased. Additionally, if you’re carrying a balance on your credit cards, higher credit utilization can lead to more interest charges on your debt.

Other Factors That Can Affect Your Credit Scores

Lowering your credit limits is not the only factor that can harm your credit scores. Several other factors credit scoring models consider when calculating your scores, including:

- Payment History: Your credit scores can be harmed if you make late payments, miss payments, or default on your payments.

- Credit Mix: Your credit score depends on the types of credit accounts you have, like credit cards, auto loans, student loans, and mortgages. It’s better for your credit score to have a variety of different types of credit.

- Length of Credit History: Credit scoring models take into account the age of your oldest and newest credit accounts, as well as the average age of all your accounts when determining your credit scores. Therefore, having a longer credit history may result in better credit scores.

- New Credit: When you apply for new credit accounts, your credit scores may decrease for a little while because it suggests that you could be taking on additional debt or experiencing financial challenges.

- Identity Theft

Tips for Maintaining Good Credit Scores

To ensure your financial health, it’s crucial to maintain a good credit score. To help with this, here are some tips for keeping your credit score in good condition:

- To avoid negative consequences like damage to your credit scores, late fees, and interest charges, please ensure that you pay your bills before the due date.

- To maintain a good credit score, aim to use only 30% or less of your available credit.

- To improve your credit score, it’s important to have a variety of credit types, such as credit cards, installment loans, and other types of credit. This shows credit scoring models that you are capable of managing different forms of credit responsibly.

- It is advisable not to close old credit accounts. Even if you don’t use them frequently, keeping them open can benefit your credit score as closing them may decrease the amount of credit available to you and shorten your credit history.

- To maintain a good credit score, it is important to pay your bills on time. Late payments can harm your credit score. You can set up automatic payments or reminders to help you remember due dates.

- To ensure accuracy, check your credit report regularly and challenge any mistakes. Visit AnnualCreditReport.com to receive a free annual copy of your credit report from Equifax, Experian, and TransUnion.

In summary, asking for lower credit limits can hurt your credit scores because it reduces the amount of available credit you have and can increase your credit utilization. To maintain good credit scores, it’s important to keep your credit utilization low, maintain a good mix of credit, avoid closing old credit accounts, pay your bills on time, and monitor your credit report for errors. By following these tips, you can help ensure that your credit scores stay healthy and strong.

How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023

How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023 How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023

How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023 How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023

How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023 How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023

How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023 How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023

How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023