Credit scores play an important role in determining creditworthiness for lenders, and FICO scoring models alone are among the most commonly used models in the United States. FICO regularly releases updated versions of its models to reflect changes in consumer behavior and credit reporting. Understanding the differences between these models is crucial to managing your credit effectively. In this article, we will provide an in-depth look at the most commonly used FICO credit scoring models, with score versions including FICO 8 and FICO 9, as well as the newest versions, FICO 10 and FICO 10 T.

The Basics of the FICO Scoring Model

The FICO scoring model is a proprietary algorithm created by Fair Isaac Corporation (FICO) that assesses various factors that can impact an individual’s credit risk. These factors include payment history, credit utilization, length of credit history, types of credit, and recent credit inquiries. FICO releases updated versions of its scoring models every few years to reflect changes in consumer behavior and credit reporting. Since not all lenders use the same FICO scoring model, it is important to understand the differences between them and how they can impact your credit score.

FICO 8: The Most Commonly FICO Scoring Model Used Version

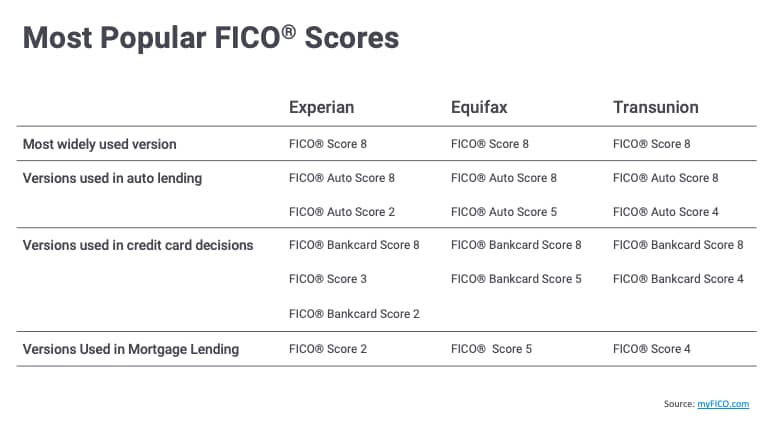

FICO 8 is the most widely used version of the FICO credit scoring model, used by over 90% of lenders in the US. It takes into account the borrower’s payment history, credit utilization, full credit limits, length of credit history, types of credit, and recent credit inquiries when calculating the credit score. However, it has a few new features that borrowers should be aware of when applying for credit. FICO 8 score is more sensitive to high credit utilization, which refers to the amount of credit you are currently using compared to your total credit limit. It is also more forgiving for one-off late payments of 30 days or more, provided that all other accounts are in good standing. Moreover, there are two sub-versions of the FICO score for 8: FICO 8 Auto and FICO 8 Bankcard.

FICO 9 vs. FICO 8: The Differences That Matter

FICO 9 is the newest version of the FICO scoring model, released in 2014. It has some notable differences from FICO 8 that can significantly impact your credit score. One of the most significant changes in the FICO score 9 scoring criteria is the treatment of collections accounts. FICO 9 counts medical collections on credit reports less harshly than other types of collections, which means that a borrower with medical collections on their credit report may see a higher credit score under the FICO score 9 than under FICO 8. FICO 9 also disregards paid collections accounts and distinguishes between collections resulting from medical debt and non-medical debt. Another key difference is that FICO score 9 places more emphasis on recent credit behavior, such as the last 24 months than the FICO score 8 does.

FICO 10 and FICO 10 T: The Newest FICO Scoring Models

FICO 10 and FICO 10 T are the two newest versions of the FICO scoring model, released in 2020. FICO 10 T takes into account trends in a borrower’s credit behavior over time, while FICO 10 does not. Both models take into account a borrower’s payment history, total debt levels, number of inquiries, types of credit used, and length of the credit card using history when calculating the score for mortgage loans. Additionally, FICO 10 T is more forgiving of late payments and makes it easier for borrowers to qualify for loans.

Comparison of FICO and Other Scoring Models

While FICO is the most widely used credit scoring model in the United States, there are other models that lenders may use to assess creditworthiness. One such model is VantageScore, which was created by the three major credit bureaus, Experian, Equifax, and TransUnion. The VantageScore 4.0 model, which is the current iteration of this model, uses a distinct scoring range when compared to FICO’s; its score varies from 300 to 850. Like the FICO credit scores, VantageScore takes into account payment history, credit utilization, credit mix, age and depth of credit, and recent credit behavior when calculating scores. However, there are some notable differences between VantageScore and FICO credit scores, such as the fact that VantageScore can take into account rent payments and utility bills when calculating credit scores, while FICO scores does not.

Another model that lenders may use is the TransUnion CreditVision scoring model, a score which takes into account the borrower’s complete credit history, including up to 30 months of credit activity. The model also considers alternative data, such as rental and utility payment history, in addition to traditional credit factors. CreditVision scores range from 300 to 850, and like FICO scores, a higher credit and score indicates lower credit risk.

How to Improve Your FICO Score

Regardless of which version of the FICO score, or other credit scoring models a lender uses, there are several steps you can take to improve your credit score. Here are some tips:

Pay your bills on time: Late payments can significantly impact your credit score, so it is essential to pay your bills on time.

Keep credit utilization low: High credit utilization, or the amount of credit you are currently using compared to your total credit limit, can negatively impact your credit score. Keeping your credit utilization low can help improve your score.

Maintain a mix of credit: Having a mix of credit, such as credit cards, installment loans, and mortgages, can positively impact your credit score.

Monitor your credit report: Check your credit report regularly for errors or fraudulent activity, as these can also negatively impact your credit score.

Use credit responsibly: Avoid opening too many new credit accounts at once, as this can make you look like a high-risk borrower. Only open new accounts when necessary and use credit responsibly.

Conclusion

Credit scores are a crucial tool for lenders to assess the creditworthiness of borrowers, and the FICO credit scoring model is one of the most widely used of credit bureau models in the United States. Understanding the differences between the various FICO credit score models and other available credit reporting agencies and scoring models can help you take steps to improve your credit score and increase your chances of being approved for credit. By following the tips outlined in this guide, you can improve your credit score and achieve your financial goals.

How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023

How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023 How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023

How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023 How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023

How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023 How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023

How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023 How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023

How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023