Stocks are a well-known investment option, but as an alternative to stocks, real estate investment offers lower risk, better returns, and provides greater diversification. Real estate also has little interdependence and is less volatile than the stock market.

According to statista.com, the global real estate market is projected to reach $613.6 trillion in 2023; the residential market alone is almost $500 trillion. The real estate market is one gigantic pie to be had. The large global real estate market size provides investors with diversification opportunities. These include international markets and integration and allow investors to diversify their portfolios by investing in real estate assets across different countries and regions with various types of assets. By diversifying their investments, investors can manage risk and potentially enhance their returns.

It’s common knowledge that investing in real estate can be very lucrative with time, patience, and the right circumstances. Some benefits of investing in real estate include passive income, monthly cash flow, tax benefits, diversification of your investment portfolio, and your property’s appreciating value.

A study by Diop entitled “Real Estate Investments, Product Market Competition, and Stock Returns” (2017) introduces product market competition as a determinant of the relationship between real estate investments and stock returns. The study suggests that real estate investments can provide diversification benefits and enhance portfolio performance, indicating better returns than the stock market.

Factors to Consider Before Investing

Before you begin, you will need to assess your financial readiness. Evaluating your financial readiness means checking your credit report, setting your budget, studying your financial options, and creating a roadmap for your financial goals. If your credit is less than stellar, you will be hit with a higher interest rate.

You can test your financial literacy by completing a learning module. Mitchell Lusardi & Mitchell (2011) conducted a case study in 2013 with employees of the US Federal Reserve System, and the study found that completing a financial literacy learning module led to significant changes in retirement planning behavior and better-performing investment portfolios. The financial literacy learning module highlights the positive impact of financial education on individuals’ preparedness for investment decisions.

The financial literacy learning module typically covers budgeting, saving, banking and different types of accounts, credit and debt, investing, retirement planning, taxes, insurance, financial goals, estate planning, real estate, personal finance management strategies, and much more.

You will spend much time on the type of real estate financing that will fit your needs unless you plan to pay cash. Depending on your liquidity, downpayment, and credit score, there are many loan products to choose from. The higher your credit scores, the more options you have.

You will need to decide on the asset type you want to invest in, do a location analysis by evaluating different neighborhoods, and consider proximity to transportation, amenities, and employment centers. Execute market research and analysis on trends and conditions in your chosen neighborhood.

Don’t forget that property management, maintenance, and risk management, such as economic downturns, vacancy and collections, tenant issues, and an exit strategy, will also be part of your roadmap toward your end game.

Pro Tip 💡: Residential real estate properties are considered an investment if the asset is not owner-occupied and is owned for financial gain, such as a rental. And assuming this is the case here since this is, in fact, an introduction to real estate article, you will be subject to a higher interest rate already because your investment property is NOT owner occupied.

Real Estate Investment Strategies to Consider

Ask yourself if this will be a long-term buy and hold for monthly cash flow as you build equity over time or a fix, flip, and renovate for a quick turnaround and profit.

Other strategies include investing in publicly traded real estate investment trusts (REITs) with extensive real estate portfolios, many of which pay sizable dividends. Lastly, there is also real estate crowdfunding.

Sometimes, something as simple as renting a room can start your journey into real estate investing.

Long-Term Buy and Hold

Long-term buy-and-hold investments in property are homes you own and rent to tenants for long-term leases. These types of property investments can provide the investor with a continuous source of income for many years. The property also appreciates, builds equity, has passive income generation, tax advantages, portfolio diversification, and protects against inflation.

Rental properties like this should cover your mortgage payment, real estate taxes, homeowner’s insurance, and maintenance costs.

Fix and Flip

The best advantage to doing a fix-and-flip strategy is the potential for high, quick returns. Ideally, you would like to look for foreclosures and make value-added improvements. Once it is completed, you sell it for a significantly higher price. When using this strategy, you, as the investor, should pay no more than 70% of the property after repair value (ARV) minus the cost of repairs.

For instance, your home will be worth $200,000. You should pay no more than $200,000 x .7= $140,000. Then, you subtract your cost of repairs. You will want to keep your cost of repairs as close to the purchase price to maximize your profit.

REITs or Real Estate Investment Trusts

A real estate investment trust is a trust that owns a wide variety of income-producing properties across many sectors. These investments can help further diversify your real estate portfolio without much investment. You can invest in them individually or through a mutual fund or a publicly traded company over the exchange.

Do your due diligence if you want to invest directly in properties that generate rental income or others that invest in real estate debt or REITs that focus on shopping centers, storages, hotels, hospitals, etc., or if you are looking for high-yield dividends.

Real Estate Crowdfunding

Crowdfunding is the newest way people looking for funding use the internet and social media to raise awareness and funding from many people. It is used by musicians, authors, people with mounting medical bills, and anything under the sun, including real estate.

Unlike publicly traded securities, real estate investments through crowdfunding platforms may lack liquidity and can be full of scammers.

Types of Real Estate Investments

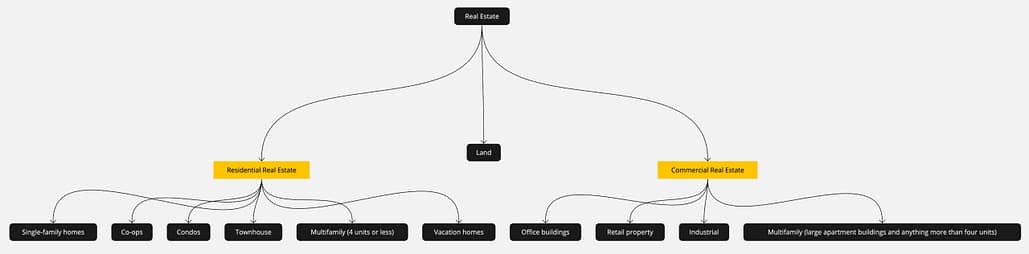

The three most common real estate property classes you will likely invest in are residential, commercial, and land.

Residential Real Estate

The residential real estate subcategory consists of:

- single-family homes

- co-ops

- condos

- townhouse

- multifamily (4 units or less)

- vacation homes

Most real estate investors opt for this type of investment and make up most of the global marketplace.

Single-family residences: Single-family residences are free-standing detached homes for one family to live in. Single families are typically inventory in the suburbs, a house in an extensive planned urban development (PUD).

Co-ops: Co-ops are typically geared towards apartment dwelling type of ownership. All the co-owners own shares of the corporation, and the corporation gives them a proprietary lease, which provides them with the legal right to live in the unit. These are the prevalent types of inventory in NYC.

A co-op board that heavily screens the prospective tenant who wants to purchase building shares. One reason for their stringent screening is that a corporation of its inhabitants jointly owns the building. And one bad tenant can drag the whole corporation down.

Condos: Condominium ownership is individually owned units within a larger building or complex with shared amenities. Condo owners own the four walls. They pay condo fees to cover maintenance costs and common area upkeep. The condo fees are a percentage of your share of the building costs. For instance, if you own a duplex apartment in NYC, your condo dues will be considerably higher than a one-bedroom or studio unit in the same building. This type of living is a good option for first-time buyers or those looking to downsize. Condo owners are responsible for any repairs or maintenance inside their units.

Townhouses: Townhouse ownership is the second most popular form of ownership behind the (SFR) single-family residence. Here, you own all the walls of your property’s front and rear yard, no matter how small. This type of ownership is between a condo and an SFR and has a common wall attached to another residence. They typically look like narrow, vertical, multi-storied homes. They are still considered single-family residences but have more privacy than condos.

Multifamily: A multifamily ownership is a single building subdivided into multiple units where numerous families live in one complex. To be considered residential in this category, it has to be comprised of four units or less. The multifamily dwelling is an excellent real estate investment that pays for you to live free. It is also known as a duplex, triplex, or fourplex.

Commercial Real Estate

The commercial real estate subcategory consists of:

- office buildings

- retail property

- industrial

- multifamily (large apartment buildings and anything more than four units)

In commercial real estate, classes of buildings are broken down into A, B, and C. Location, building age, amenities, architectural aesthetics, and condition determine the class.

Class A building is new, state of the art, high-quality construction, excellent location, high-profile with best-in-class features.

Class B buildings are usually about 10-20 years old and are in good overall condition with decent location amenities and have fair to good appeal.

Class C buildings typically make up smaller businesses or family-run businesses and are often 20+ years or older, usually offer below market rent, and are the cheapest price point.

Property Management and Risk Management

Effective property and risk management is vital for property owners and investors to protect their assets and minimize potential financial losses. Here are some strategies for effective property and risk management. The list is not complete, but it is a good base.

Maintaining proper insurance coverage

As an investor, you will want to protect your assets by obtaining proper insurance coverage and reviewing your policies each year.

Conduct ocular inspections

Ocular inspections can help spot routine maintenance issues and help address the issues immediately before they get worse.

Implement security measures

Installing cameras, proper lighting, locks, and securing windows and doors from unauthorized access will help further protect your property.

Proper tenant screening

Vet tenants thoroughly with background and credit checks. Asking for past landlord references and verifying them can help prevent your vacancy and collections.

Drafting proper lease agreements

Draft a lease agreement that clearly outlines the tenant’s responsibilities, property maintenance, rental payment terms, and consequences for lease violations.

Maintaining financial reserves

If a building boiler breaks, you must establish emergency financial reserves for unexpected maintenance repairs or vacancies.

Come up with a regular maintenance schedule.

Being proactive about regular maintenance, such as hiring gardeners to clear the grounds every week or two weeks to keep them in good condition, helps prevent maintenance issues from becoming costly problems in the future.

Good record keeping

Keep detailed records of all property-related transactions, such as repairs, maintenance issues, or upgrades.

Specialized Real Estate

The specialized real estate subcategory consists of and not limited to:

- Storage Facilities

- Healthcare Facilities

- Senior Living

- agricultural land

- amusement parks

- Parking Lots

- Stadiums

- Bowling Alleys

- Theatres

- Zoos

This category is more of a particular purpose or miscellaneous category of commercial real estate.

Conclusion

Real estate investing has unlimited potential and opportunities waiting to be seized. With the proper planning, due diligence, and strategy, you can chart a lucrative path toward personal financial growth and security. Your future is shaped by the financial decisions you make today.

Start your real estate journey today with the knowledge you’ve gained here. With the right mindset, dedication, and a willingness to learn, you’re not just investing in properties, but you’re investing in your future. Don’t let money control you, but take control of your money and start building your financial legacy today.

FAQ

Why do townhouses not appreciate in value as much as single-family residences?

One reason that townhouses do not appreciate as much as single-family residences is that townhouses have limited options to add value, unlike a home or single-family- residence, which are homes you see in planned suburban developments, where you can put a pool, upgrade a basement, or add an extra addition to the home. Another reason is almost always what is appreciating is the land, not the building. Because buildings depreciate and land does not.

Conversely, townhouses are easier to maintain and less expensive than single-family residences due to their smaller footprint, making them desirable to those looking to downsize or don’t want an asset with heavier maintenance burdens.

What is the concept of commercial building?

Commercial buildings are properties where commercial activities occur, such as office buildings, retail space, and industrial warehouses. However, large multifamily buildings like apartments with more than four units are also considered commercial, but commercial property (because it includes multifamily units), and NOT commercial buildings.

Commercial property buildings such as multifamily do not deal in any commercial activity such as selling, warehousing items, or using for office space. However, they are still income-producing properties for the owners. However, some mixed-use buildings with retail or office spaces on the ground floor can be considered commercial in certain instances because those units on the ground floor are explicitly used for commercial activities.

How do I avoid putting a 20% down payment on an investment property?

If you own a home, you can use the equity in your home to do a cash-out refinance, get a home equity line of credit (HELOC), or explore seller financing. Exploring these alternative financing options will ease the burden of significant cash out of your pocket. Some investment property lenders will accept a 15% down payment, but this will depend on your credit score, debt-to-income ratio, loan repayment plan, and property type.

A cash-out refi is when you take out a new loan that will pay off your existing home loan and leave you with a lump sum. You need a minimum of 20% equity in your home to avail of this. Suppose you have considerable equity in your home and are paying the 3-4% interest rates. In that case, you may want to try to find another avenue because your new mortgage will double with interest rates at 8% currently. Taking out your new loan for investment may not be cost-effective. Do the math.

A HELOC or home equity line of credit is like a credit card with revolving credit and a variable rate. These home equity lines of credit allow for the withdrawal of funds up to 10 years and 20 years to repay, whereas a cash-out refi term can be up to 30 years.

Can I invest $ 1,000 in real estate?

Is it never too late, or is there too small an amount that you can invest in real estate? You can explore fractional ownership properties on several platforms, such as Arrive Homes and Roofstock One. There are also crowdfunding platforms like EquityMultiple, Crowdstreet, and Realty Mogul. You can also buy into REITs through a brokerage account. REITs have no minimum to entry and can give great dividends. REITs are one great way to dip your toe in the water with some heavy hitters without too much exposure on your part.

How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023

How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023 How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023

How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023 How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023

How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023 How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023

How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023 How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023

How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023