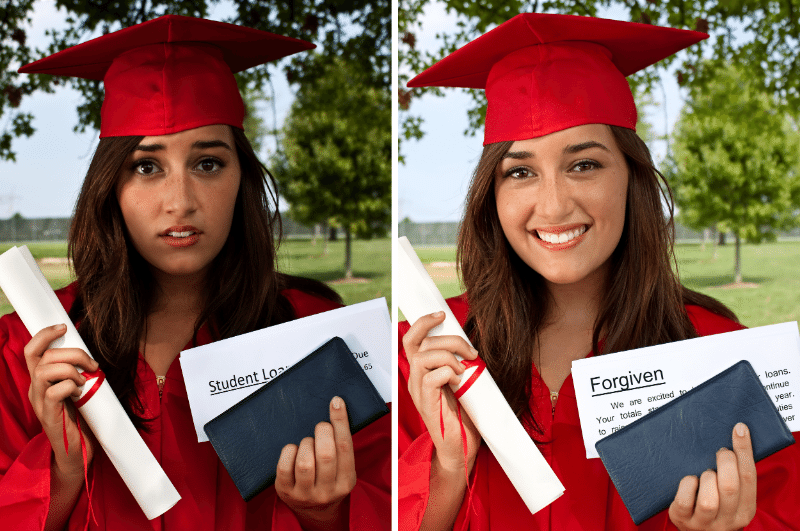

The fate of millions of borrowers and the future of student loan forgiveness hang in the balance as the Supreme Court is set to rule on this contentious issue. With legal challenges, potential outcomes, and various implications, it’s crucial to stay informed and prepared for what’s to come. In this post, we’ll delve into the anticipation surrounding the question of “when will the Supreme Court rule on student loan forgiveness?”, the legal challenges faced, potential outcomes, and how to prepare for student loan repayment. Let’s embark on this journey to understanding the intricacies of the Supreme Court’s upcoming ruling on student loan forgiveness.

Short Summary

- Anticipation is high as the Supreme Court prepares to rule on student loan forgiveness.

- Key dates and SCOTUSBlog should be monitored for updates, while understanding legal challenges and potential outcomes are essential.

- Eligibility criteria may provide up to $20,000 in debt relief for qualified individuals or couples earning less than certain income thresholds.

Anticipating the Supreme Court Decision

The Supreme Court’s ruling on student loan forgiveness is anxiously awaited by millions of borrowers, with key dates, such as June 27 and June 29, fast approaching. As the future of student debt relief remains uncertain, staying updated on the court’s decision and monitoring sources like SCOTUSBlog for real-time information is crucial for those affected by the outcome of this landmark case.

It is important to stay informed and be aware of the potential implications of the ruling. Knowing the facts.

Key Dates to Watch

The Supreme Court is anticipated to deliver a supreme court ruling on student loan forgiveness on June 29th. However, the term could be extended, making the supreme court’s decision timeline uncertain.

This ruling will have significant implications for borrowers and the federal government, so staying informed on these crucial dates is paramount for those with student loans.

Monitoring SCOTUSBlog

SCOTUSBlog provides real-time updates on Supreme Court decisions, including the ruling on student loan forgiveness. By monitoring SCOTUSBlog, you can stay informed on the latest developments in the case and any implications for borrowers and the federal government.

As the decision draws near, keeping an eye on this valuable resource is essential.

Understanding the Legal Challenges

The legal challenges to Biden’s student loan forgiveness plan are multifaceted, with critics arguing that it doesn’t address the cost of college for future students and could lead to an increase in tuition. The court’s ruling may be based on standing, or whether plaintiffs can prove they are harmed, or on the merits of the plan itself.

Navigating these legal challenges is vital to understanding the potential outcomes and their implications for borrowers.

Arguments Against Forgiveness

Critics of Biden’s student loan forgiveness plan argue that it doesn’t address the cost of college for future students and could result in higher tuition costs. They also contend that it is inequitable to those who have already paid off their loans or opted not to take out loans in the first place, as they would not benefit from the forgiveness plan.

These arguments highlight the complexities of the issue and the challenges faced by the Biden administration.

Standing vs. Merit

The Supreme Court’s ruling on student loan forgiveness may hinge on the issue of standing, which requires challengers to demonstrate that they are directly and adversely impacted by the federal law or policy in question. If the court focuses on standing, the fate of the student loan forgiveness plan will depend on whether the plaintiffs can prove they have suffered harm as a result of the plan. As the supreme court strikes a balance between the arguments, the outcome remains uncertain.

On the other hand, if the court rules based on the merits of the plan itself, they will consider whether the Department of Education has the legal authority to cancel the student loan debts of millions of Americans. This could lead to a more in-depth examination of the plan and its implications, potentially resulting in a more nuanced outcome for borrowers and the federal government.

Potential Outcomes and Their Implications

Depending on the Supreme Court’s decision, the outcome could either pave the way for millions of borrowers to receive debt relief or confirm that they are solely responsible for repaying their loans. If the court rules in favor of forgiveness, the Department of Education’s forgiveness-application portal may reopen quickly, providing relief to eligible borrowers.

However, if the court rules against forgiveness, the Biden administration may need to devise an alternative plan or take steps to ease repayment options for borrowers.

Ruling in Favor of Forgiveness

A favorable ruling for student loan forgiveness could lead to the reopening of the Department of Education’s forgiveness-application portal and quick debt relief for eligible borrowers. This outcome would be a major victory for those advocating for student loan forgiveness and could provide much-needed financial relief to millions of Americans struggling with student loan debt, with some even having their debt forgiven.

Ruling Against Forgiveness

If the Supreme Court rules against student loan forgiveness, the Biden administration may come up with an alternative plan or take steps to make it easier for borrowers to repay their loans, potentially providing student debt relief. While this outcome would be disappointing for those hoping for widespread debt relief, it could still result in policy changes that benefit borrowers and alleviate some of the burden of student loan debt.

For example, the administration could expand income-driven repayment plans, which allow borrowers to make payments.

Preparing for Student Loan Repayment

As student loan payments are set to restart in October, borrowers should contact their loan servicer for any questions and may need to reauthorize automatic debit. Staying proactive and prepared for the resumption of loan payments is crucial, regardless of the Supreme Court’s decision on student loan forgiveness.

It is important to remember that loan payments will resume regardless of the Supreme Court’s decision.

Contacting Your Loan Servicer

Borrowers should contact their loan servicer for any questions about their loans and repayment options as payments are set to restart in October. By reaching out to their loan servicer, borrowers can ensure they have the most accurate and up-to-date information about their loans and any changes that may result from the Supreme Court’s ruling.

It is important to stay informed and to contact your loan servicer if you have any questions.

Reauthorizing Automatic Debit

Borrowers may need to reauthorize automatic debit for their student loan payments as they restart in October. By reauthorizing automatic debit, borrowers can ensure their payments are processed on time and avoid any potential issues with late or missed payments.

Automatic debit is a convenient way to make sure payments are made on time and can help borrowers.

Eligibility and Debt Forgiveness Amounts

Eligibility for student loan forgiveness is based on income, with those earning less than $125,000 in 2020/2021 or $250,000 for couples eligible for up to $10,000 in debt forgiveness. Pell grant recipients could receive up to $20,000 in forgiveness, providing significant relief to those who qualify.

Understanding eligibility criteria and potential forgiveness amounts is crucial for borrowers as they navigate the uncertain future of student loan forgiveness.

Income-Based Eligibility

Income-based eligibility for student loan forgiveness includes two student loan borrowers earning less than $125,000 in 2020/2021 or $250,000 for couples, who may receive up to $10,000 in debt forgiveness. Being aware of these income thresholds can help borrowers better understand their potential eligibility for student loan forgiveness and plan for the future accordingly.

By understanding the income thresholds, student loan borrowers can make informed decisions about their student loan debt and plan for it.

Pell Grant Recipients

Pell Grant recipients may be eligible for up to $20,000 in Biden’s student loan forgiveness under his plan. These grants are awarded to students from low-income backgrounds, and this additional forgiveness amount could provide significant relief to those who are struggling to repay their federal student loans.

Understanding the implications for Pell Grant recipients is crucial for those who may qualify for this additional forgiveness.

Summary

In conclusion, the Supreme Court’s decision on student loan forgiveness is a pivotal moment for millions of borrowers and the future of student debt relief in the United States. As we await the ruling, it’s crucial to stay informed on the legal challenges, potential outcomes, and implications for borrowers. Whether the court rules in favor of forgiveness or against it, understanding eligibility criteria, potential forgiveness amounts, and the importance of preparing for student loan repayment will help borrowers navigate this uncertain time. Remember, knowledge is power, and staying informed is the key to facing the future with confidence.

Frequently Asked Questions

Will student loan forgiveness eventually go through?

It looks increasingly likely that student loan forgiveness will eventually go through. With the recent extension of the Biden administration’s pause on federal student loans and the proposed debt ceiling deal set for June 2023, a final decision is expected to be made soon.

This could be a major relief for millions of Americans who are struggling to pay off their student loans. It could also have a positive impact on the economy.

How do I know if I was approved for student loan forgiveness?

To know if you have been approved for student loan forgiveness, you can check the status of your application by logging into StudentAid.gov or contacting your loan servicer or lender.

Additionally, you can track your PSLF progress by visiting MOHELA’s website or calling them at 1-855-265-4038. Be aware that response time may be delayed due to historic submission volume.

What is the timeline for the Supreme Court’s decision on student loan forgiveness?

It is expected that the Supreme Court will deliver its decision on student loan forgiveness on June 29th.

However, the timeline of this ruling could be subject to change.

What should I do to prepare for student loan repayment as payments restart in October?

It is important to update contact information and ensure that the loan servicer has accurate financial records.

As October approaches, borrowers should take the time to contact their loan servicer, update contact information, review their repayment terms, calculate a budget, and create an action plan to best manage their student loan repayment. Doing so will ensure that they are well-prepared for payments to resume.

How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023

How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023 How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023

How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023 Get Approved: Credit Score Needed For AffirmOctober 24, 2023

Get Approved: Credit Score Needed For AffirmOctober 24, 2023 How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023

How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023 How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023

How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023