Are you one of the millions of consumers struggling with credit reporting errors, only to have your complaints disregarded? You’re not alone. Consumer reporting agencies, also known as credit bureaus, often dismiss a substantial amount of credit report disputes without proper investigation. Recently, it has come to light that credit bureaus are discarding over two million disputes every year without conducting any investigation into the matter. This is an issue that urgently requires attention and understanding of how it impacts consumers nationwide. Let’s delve further into this issue.

Vague Criteria Used by Credit Bureaus to Decide Which Complaints to Investigate

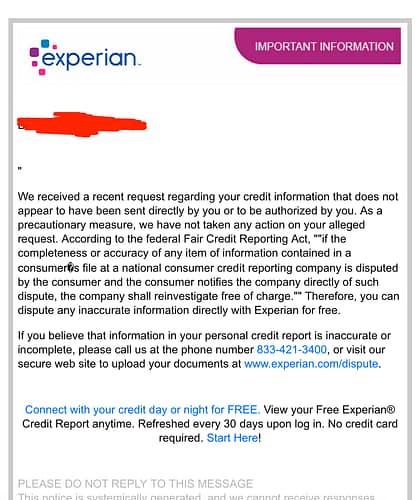

This recent investigation has highlighted some of the long-standing problems with consumer reporting agencies and their discarding of millions of disputes each year. However, what’s even more concerning is that recent reports show how Equifax, Experian, and TransUnion use vague criteria to decide which complaints to investigate. For example, Equifax considers “identical language and format” or complaints originating from the same zip code as disputed credit reports as signs that a complaint is coming from a credit repair service – all without any investigation. Consumers should be aware of their rights and responsibilities under the Fair Credit Reporting Act (FCRA), such as the right to an accurate report and the right to dispute errors promptly. They should also take steps to ensure their complaints are not treated as fake or insignificant when trying to resolve errors on their credit reports.

The Consequences of Discarding Disputes Without Investigation

Unfortunately, the consequences of consumers, credit reporting agencies, and credit raters not doing their due diligence are immense. Consumers are left with inaccurate or incomplete records that can negatively affect them in various ways, such as difficulty securing loans or being turned down for a job or housing. In some cases, consumers have to invest significant amounts of time and resources just dealing with the bureaucracy of fighting to finally get the information corrected. This kind of complex process can be especially daunting for those unfamiliar with the American credit system, potentially taking away their ability to access credit in a system designed to create financial and economic opportunities. Furthermore, many people lose out on critical monetary gains as businesses often base promises such as loyalty discounts on one’s credit score – if it is wrong they miss out, further perpetuating systemic inequalities.

Understanding the Role of Credit Bureaus and the Importance of Investigating Disputes

Credit bureaus play an important role in the financial system by collecting and maintaining information about individuals’ credit histories and payment behaviors. This information is then used by lenders, landlords, employers, and others to make decisions about whether to extend credit, offer employment, or enter into other financial arrangements with an individual.

When individuals dispute information on their credit reports, credit bureaus must investigate the dispute and ensure that the information they report is accurate. Discarding disputes without investigation goes against this fiduciary duty because it means that the credit bureaus are not taking appropriate steps to ensure the accuracy of the information they are providing. This can have serious consequences for individuals who may be denied credit, employment, or other opportunities based on inaccurate information on their credit reports.

Barriers and Obstacles: Exploring the Challenges Faced by Consumers in Disputing Credit Report Errors

According to a recent study by the Federal Trade Commission (FTC), approximately 1 in 5 consumers has an error on their credit report. These errors can range from minor mistakes, such as misspelled names or outdated addresses, to more serious inaccuracies like fraudulent accounts or incorrect payment information. The study also highlighted trends that found that of the disputes filed by consumers with the three major credit bureaus (Equifax, Experian, and TransUnion), only about 20% resulted in a modification of the credit report. In other words, the majority of disputes were either discarded without investigation or were found to be without merit. Given that credit reports are used by lenders, landlords, employers, and others to make decisions that can have significant financial consequences for consumers, these errors can have a substantial impact on individuals’ lives.

Lack of knowledge: Many consumers do not know their rights when it comes to disputing credit report errors. They may not be aware of the proper procedures for filing a dispute or the types of errors that can be disputed.

The burden of proof: The burden of proof is on the consumer to provide evidence that an error exists on their credit report. This can be challenging for consumers who may not have access to the necessary documentation.

Lengthy process: Disputing credit report errors can be a lengthy process, often taking several months or even years to resolve. During this time, inaccurate information may continue to negatively impact the consumer’s credit score.

Inconsistent responses: Consumers may receive inconsistent responses from credit bureaus, with some disputes being resolved quickly while others drag on for months.

Limited recourse: If a consumer’s dispute is not resolved to their satisfaction, they may have limited recourse. While they can file a complaint with the Consumer Financial Protection Bureau (CFPB), the CFPB does not have the power to force credit bureaus to take specific actions.

What Can Be Done to Change This Practice – Rights Consumers Have and How They can Fight for Them

The current approach to consumer complaints and resolving disputes raised by consumers is outdated and inefficient. To ensure that their rights are upheld, consumers must be made aware of the ways they can protect themselves, such as filing a report with the Consumer Financial Protection Bureau (CFPB) and making use of the Federal Trade Commission’s (FTC) dispute page. Additionally, they should understand how the FCRA works and what to do when there has been a data breach or other violation from a credit reporting agency or another lender. Consumers should also be informed of their legal options if they experience negative outcomes resulting from errors in their credit reports, such as incorrect refusal of loan approval or unfavorable interest rates. Furthermore, raising awareness about existing regulations as well as pushing for new laws that safeguard consumer finances is critical to improving overall financial health and security.

Potential Solutions Already in Place – What’s Being Done to Make Credit Reporting Fair for Consumers

With the influx of issues that consumers are facing when dealing with credit reporting errors, it is becoming increasingly important for organizations to take steps toward addressing legitimate requests and creating an effective solution. Many companies have implemented dispute resolution processes that range from basic document review and automated scoring systems that can quickly see bad data and assess the nature of a dispute to more comprehensive dispute investigation systems. These advancements have not only improved the speed and accuracy of credit rating decisions, but they make sure that the decision-making process is fair and unbiased. For example, machine learning algorithms can be trained to identify patterns in data that indicate discrimination against certain groups, such as race or gender, and adjust their decision-making process accordingly.

Furthermore, AI and machine learning can also be used to mine credit accounts and detect fraud and other types of financial crimes, which can help prevent financial losses and protect consumers’ credit scores. With these tools, financial institutions can be more confident in their lending decisions and offer more competitive rates and products to their customers.

Overall, the use of AI and machine learning in credit rating and lending decisions has the potential to greatly improve the accuracy, fairness, and efficiency of the financial system. However, these technologies must be developed and used responsibly, with appropriate safeguards in place to ensure that they are not used to perpetuate discrimination or harm consumers.

Empowering Consumers with Actionable Steps to Take – What Can Consumers Do To Combat Errors in Their Credit Reports

Credit reporting errors can have a major financial impact on individuals and families, yet many consumers feel powerless when it comes to budgeting amidst incorrect credit assessments. Consumers must understand their rights and assert them proactively by taking precautionary steps in monitoring their credit reports. The Consumer Financial Protection Bureau recommends familiarizing yourself with the Fair Credit Reporting Act, which enables consumers to obtain a free copy of their credit report every 12 months from each of the 3 major bureaus: Experian, TransUnion, and Equifax. Checking your report frequently makes it easier to spot any mistakes or unrecognizable activities that could potentially be damaging your score. Secondly, question unfamiliar credit inquiries or mismatched data as soon as possible – don’t hesitate to send dispute letters or contact customer service representatives at the credit bureaus. Though problems haven’t been adequately addressed in the past, staying abreast of your own records will enable you to compete with ever-changing industry trends and remain ahead of potential errors in the long run.

Closing Thoughts – The Necessity of Holding Credit Bureaus Accountable For Their Actions

As it stands today, consumer reporting agencies have been unresponsive to consumers facing credit reporting errors, and even discarding their disputes in large numbers. This behavior is unacceptable and must be addressed. We need to take meaningful steps to hold credit bureaus accountable for their actions, as we are working together to improve the banking and credit experiences of millions of people. It is clear that by standing up for ourselves and our rights in this matter, everyone will benefit from transparency and fairness in the lending industry.

How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023

How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023 How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023

How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023 How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023

How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023 How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023

How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023 How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023

How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023