Creating a personal budget can often seem like a daunting task. However, crafting and sticking to a budget is one of the most crucial steps in taking control of your financial life and achieving long-term success. The 50/30/20 tool is a straightforward budgeting strategy that has helped many people find their path to financial enlightenment. It’s an easy-to-follow method that can lead to significant financial improvements with minimal stress.

What is the 50/30/20 Rule?

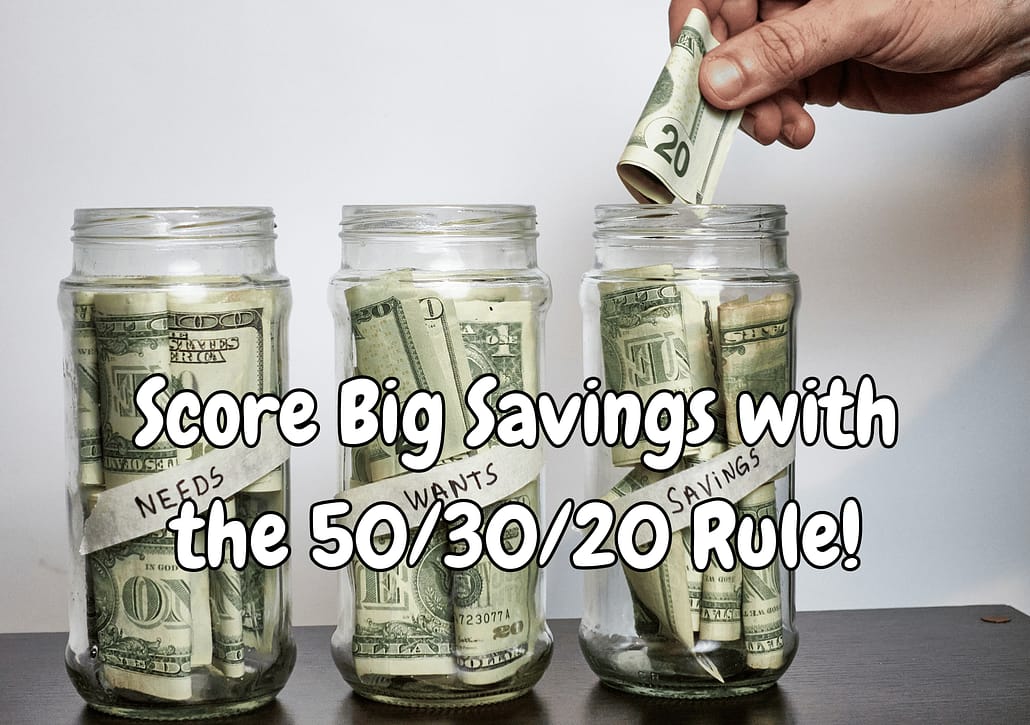

The 50/30/20 rule, introduced by US Senator Elizabeth Warren and her daughter Amelia Tyagi in their book “All Your Worth,” outlines a simple method for managing your finances. The rule categorizes your income after taxes into three distinct spending categories:

- 50% on Needs: Essential expenses such as food, housing, transportation, and debt.

- 30% on Wants: Non-essential expenses like dining out, entertainment, and travel.

- 20% on Savings/Investing: Contributions to your emergency fund, retirement accounts, and other savings goals.

For instance, if your monthly take-home pay is $1,000, you would allocate $500 to your needs, $300 to your wants, and $200 to your savings.

| Category | Description | Examples |

|---|---|---|

| Needs (50%) | Essential expenses | Food, housing, transportation, debt |

| Wants (30%) | Non-essential expenses | Dining out, entertainment, travel |

| Savings (20%) | Contributions to your emergency fund and other goals | Emergency fund, retirement accounts |

How to Implement the 50/30/20 Rule:

- Calculate your after-tax monthly income.

- Assign 50% to essential needs and list all expenses that fall into this category.

- Allocate 30% to your wants and decide how you’ll distribute this portion.

- Designate 20% to savings and investment goals.

- Regularly track your spending and adjust percentages as needed.

The Benefits of 50/30/20 Budgeting:

The 50/30/20 rule offers multiple benefits, such as:

- Covering essential expenses first.

- Encouraging a balance between needs and wants.

- Providing flexibility to adapt to monthly changes.

- Promoting peace of mind by helping you understand your spending habits.

- Preventing lifestyle inflation by living within your means.

- Establishing a systematic approach to money management.

Tips for 50/30/20 Success:

- Start by building a $1,000 emergency fund.

- Automate your payments for fixed expenses.

- Use budgeting apps like Mint to track your spending.

- View your investments as future wealth rather than present-day money.

- Regularly adjust your budget to accommodate raises or changes in income.

- Discover powerful tactics for boosting high-yield returns to maximize your savings.

FAQ’s (Frequently Asked Questions)

How does the 50-30-20 rule work for budgeting?

The 50/30/20 rule is a simple budgeting method where you allocate 50% of your after-tax income to needs, 30% to wants, and 20% to savings and investments. This straightforward approach helps you manage your finances effectively, ensuring that you cover essential expenses while also saving for the future.

Is the 50-30-20 rule a good budget?

Yes, the 50/30/20 rule is a good budgeting strategy for many people because it provides a balanced approach to managing finances. Categorizing expenses and allocating specific percentages of income, helps individuals prioritize essential needs while also allowing room for discretionary spending and savings. Explore additional strategies to manage your finances, such as taking a side job to pay off debt.

How do you calculate 50 30 20 rule examples?

To calculate the 50/30/20 rule, start by determining your after-tax monthly income. Then, allocate 50% of that income to essential needs like housing, food, and transportation. Next, allocate 30% to wants such as entertainment and dining out. Finally, designate 20% to savings and investments, including emergency funds and retirement accounts. For example, if your monthly income is $3,000, you would spend $1,500 on needs, $900 on wants, and $600 on savings.

Is the 50-30-20 rule gross or net?

The 50/30/20 rule is based on your net income, which is the amount of money you take home after taxes and other deductions. This ensures that the budget is realistic and achievable, as it considers the actual amount of money you have available to spend and save each month.

The 50/30/20 budgeting guideline is an excellent starting point for developing a successful budgeting habit. By employing this method, you’ll be able to balance your needs and wants while simultaneously saving for the future. Remember, discipline is key to achieving long-term financial success.

How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023

How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023 How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023

How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023 How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023

How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023 How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023

How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023 How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023

How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023