Credit balances are ballooning and interest rates remain sky-high – not only that, but the holiday shopping and travel season are right around the corner.

With all the demands on our cash flow, financial stress can feel unbearable, especially for those shouldering high debt loads or with impaired credit.

It’s not unusual these days to hear about friends, family, neighbors, or colleagues picking up side jobs to knock down debt, save for a child’s college tuition, pay for a vacation, build savings, or simply bring in extra cash.

Nearly 40% of Americans have a side job, according to a survey conducted by Bankrate.com this spring.

Working multiple jobs is nothing new, of course. But the variety and flexibility of today’s side gigs, such as driving for ride-share companies, delivering restaurant orders, online tutoring, or taking on work-from-home opportunities, make it easier than ever to supplement income on both a part-time, W-2 employee level and 1099 independent contractor basis.

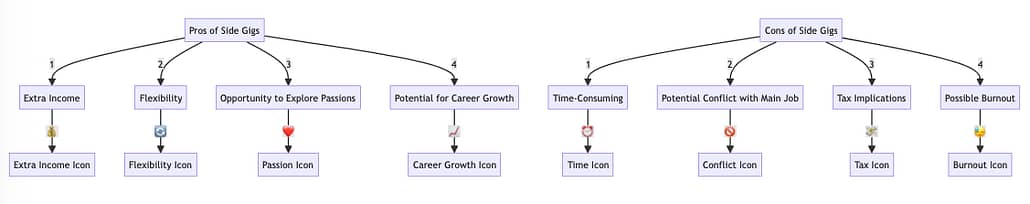

Evaluating the Pros and Cons

How do you go about deciding whether taking on a second (or third) job is the right direction for you though? Here are key factors to consider.

Assessing Your Main Job’s Policies

Ensure there is no conflict with your main job. Confirm with your employer or consult your company’s employee handbook for any restrictions on outside work. Depending on your company and your position, you may be subject to nondisclosure agreements or noncompete clauses. At a minimum, you want to ensure there is no conflict of interest – or a perception of such – between your main job and your ancillary role. You do not want to jeopardize your main source of income.

Navigating Tax Implications

Understand the tax consequences of earning additional income, whether it’s through a part-time W-2 role or as an independent contractor who receives a 1099. For questions specific to your tax scenario, consult a tax advisor. The last thing you’d want is to take on a side hustle to enhance your earnings but then face a painful surprise come tax filing time.

Setting Boundaries for Your Side Job

Place boundaries on the commitment. Additional work hours will take their toll, even if the side hustle relieves financial stress. Knowing the scope of the commitment before you start will be helpful for assessing whether it’s a responsibility you can juggle for several months – or longer – alongside your main job. Define your goals for the extra income.

For example, if your goal is to pay down ,000 of credit card debt:

- Determine how long it will take with your side gig to earn that amount.

- Assess how much time you can reasonably devote to your side job without compromising too much family time, sleep, or the focus and hours needed for your primary job.

- Does it give you a low-risk way to explore a side passion? Beyond the perk of earning extra cash, a side gig can be a great way to try a new interest and test its income potential without sacrificing the security of your primary source of wages.

- Does it give you a low-risk way to explore a side passion? Beyond the perk of earning extra cash, a side gig can be a great way to try a new interest and test its income potential without sacrificing the security of your primary source of wages.

Top Side Gigs to Consider

The Millennial Money website recently compiled a list of popular side hustles – many of which can be done from home. They include:

- Making deliveries via food delivery or grocery apps or Amazon Flex

- Driving for Uber, Lyft or other ride-share apps

- Proofreading or copyediting

- Freelancing

- Completing online surveys

- Dropshipping

- Renting out space in your home via Airbnb

- Pet sitting or dog walking

- Contributing to focus groups

- Transcription services

Each of these side gigs comes with its own set of pros and cons, and it’s important to research and consider each option carefully before diving in.

Learn about the 50/30/20 rule, a simple budgeting strategy to take control of your financial life.

Taking on a side job can be a viable option to help alleviate financial stress and pay off debt. However, it’s crucial to weigh the pros and cons, understand the commitments involved, and ensure that the side gig aligns with your main job and financial goals. With the right approach, a side hustle can provide not only extra income but also a chance to explore new interests and passions.

How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023

How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023 How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023

How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023 How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023

How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023 How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023

How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023 How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023

How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023