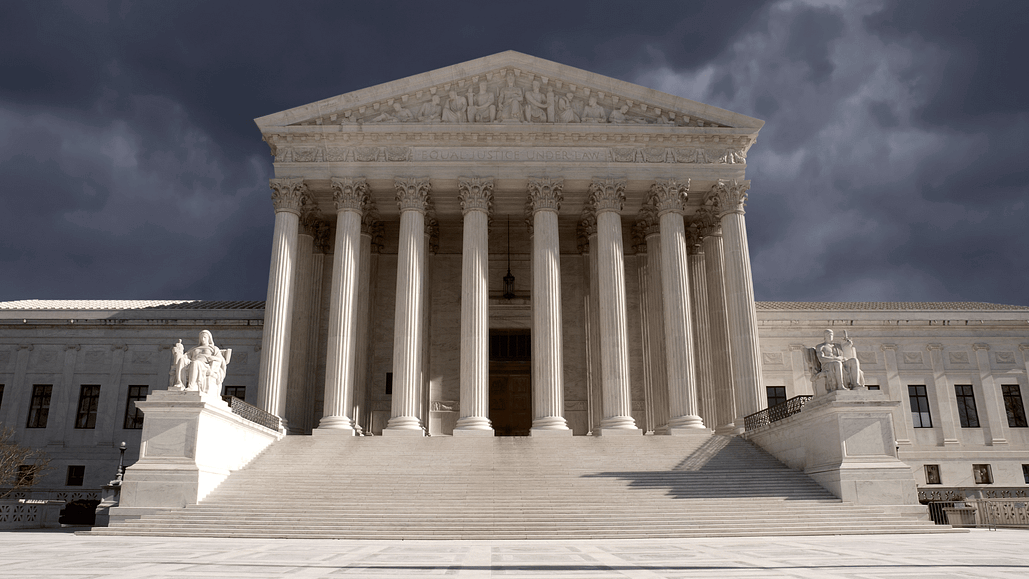

U.S. Supreme Court justices seemed to be divided during Monday’s session on whether the federal government can be held liable for errors in consumer credit reports. The case in question involves a Pennsylvania man who accused an Agriculture Department agency of damaging his credit status through mistakes. The Biden administration, seeking to block the lawsuit, appealed a lower court ruling that rejected the government’s claim of sovereign immunity in cases involving credit reporting inaccuracies.

The plaintiff, Reginald Kirtz, filed a lawsuit against the Rural Housing Service, an agency that provides loans to help lower-income Americans secure housing in rural areas. Kirtz sought monetary damages under the Fair Credit Reporting Act, a law enacted in 1970 to ensure fair and accurate credit reporting.

During the arguments, the justices displayed differing opinions on the matter. Kirtz claimed that his loans had been fully repaid, yet both the government lender and a private lender continued to report erroneous delinquency on his accounts, even after he raised concerns about the discrepancies. Subsequently, these inaccurate reports were conveyed to the credit reporting agency TransUnion, resulting in detrimental effects on Kirtz’s creditworthiness.

The Biden administration argued for the dismissal of the lawsuit, citing the doctrine of sovereign immunity. This doctrine typically protects the U.S. government from liability, unless expressly waived by law. The central matter under consideration pertains to whether Congress has relinquished sovereign immunity in relation to the Fair Credit Reporting Act.

The 1970 version of the law permitted lawsuits against credit bureaus for inaccuracies, but it did not grant the same right to sue the government. In 1996, Congress broadened the law to include the ability to bring legal action against “persons” who provide credit information to reporting agencies.

Nandan Joshi, Kirtz’s lawyer, urged the justices to interpret “persons” as including government agencies, citing the law’s broad definition of the term. Justice Elena Kagan proposed that the case could be resolved in Kirtz’s favor through the application of fundamental principles of statutory interpretation.

Justice Brett Kavanaugh expressed skepticism, suggesting that Congress must explicitly state a waiver of the government’s sovereign immunity. Kavanaugh mentioned that the Congressional Budget Office, a non-partisan agency responsible for forecasting legislation costs, did not estimate the potential litigation costs resulting from waiving sovereign immunity.

According to the Fair Credit Reporting Act, “persons” subject to the law are required to investigate disputes regarding the accuracy of credit information provided to reporting agencies. Kirtz’s lawsuit alleges that the Agriculture Department failed to investigate his dispute about the accuracy of credit information reported by its agency to credit bureaus.

In 2021, a federal judge in Pennsylvania approved the Biden administration’s plea to dismiss the case, stating that the law “does not clearly waive sovereign immunity.” However, the 3rd U.S. Circuit Court of Appeals in Philadelphia overturned that ruling the following year.

The Supreme Court’s ruling on this case could have significant implications for the liability of the federal government in credit reporting inaccuracies. The justices’ differing opinions suggest that a definitive resolution may not be easily reached. The outcome will shape the legal landscape for future cases involving consumer credit reports and the potential accountability of government agencies.

How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023

How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023 How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023

How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023 How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023

How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023 How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023

How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023 How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023

How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023