Your credit score is a numerical representation of your creditworthiness. A good credit score or credit scores indicate you’re a low-risk borrower, and lenders will be more likely to give you loans with favorable terms. But what exactly is a “good” credit score?

A good credit score is important because it shows lenders that you’re a responsible borrower

Having good credit scores is essential for a variety of reasons. A FICO credit score is primarily used by lenders to determine an individual’s level of risk, meaning that the higher your score the more trust the lender will place in you. Generally speaking, “good” or “high” credit scores fall within a range, with different ratings applying to each end of the credit score range – generally anywhere from 750 and upwards will be considered excellent credit. Similarly, anything between 650-749 can be put into the good bracket, while lower than 650 can begin to indicate some financial issues or perhaps poor credit. This means that it’s important to understand what comprises your own consumer FICO credit rating and credit scores, so that you can take steps to make sure you are seen as a responsible borrower should you ever need to borrow money in the future.

A good credit score can help you get approved for loans and lines of credit, and can also help you get better terms and interest rates

Credit scores can have far reaching effects on your financial well being. The average credit score in the United States ranges from 650 to 759, with anything above credit score range 750 categorized as excellent. This numeric range is determined by a variety of factors that are noted and tracked by the three major credit bureaus – Equifax, Experian, and TransUnion. Credit scores represent a reliable method for lenders and banks to examine people’s history of making payments on loans or balances on credit cards and keeping credit card balances below the credit limit available by 30%; companies often use credit report and credit history information to decide whether or not to approve a person for additional lines of credit. As such, having good credit scores can go a long way in helping you get approved for financial products at favorable terms and interest rates!

You can build up your credit score by making on-time payments, keeping your balances low, and using credit responsibly

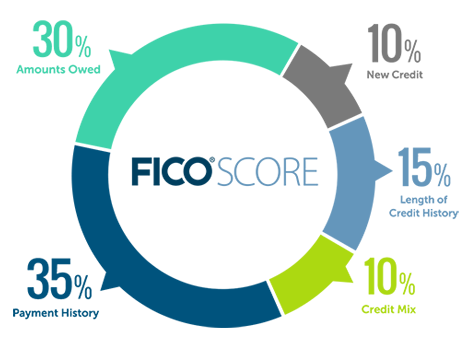

If you want to achieve credit success, then following these simple credit score building techniques is paramount – making on-time payments, keeping your credit account balances low, using credit responsibly, not exceeding the credit limit, and monitoring your credit reports regularly. How exactly does this work? Credit bureaus calculate credit scores by reviewing credit cards, bank accounts, and other financial data included in one’s credit report. Depending on a credit history’s total number of evaluations, an individual could have ranges of poor, average and excellent credit scores. Among other things such as total debt, credit utilization ratio, open accounts, credit mix and more – payment history is perhaps the most important factor in FICO’s credit score calculations as it makes up nearly 35% of the average FICO score. And if successfully adhered to, individuals can eventually top out their average credit score at 850 – the highest credit score under the credit scoring model.

There are a few things that can hurt your credit score, such as late payments, maxing out your credit cards, or having a high debt-to-income ratio

Your FICO credit score and credit mix is an important factor that lenders consider when reviewing loan or credit card applications to assess credit risk and it can range from 300 to 850, with anything over 650 being considered as a good credit score range. However, a few things can hurt your credit score on FICO credit reports, leading to a poor credit score. These include late payments on credit accounts, maxing out your credit cards, or having a high debt-to-income ratio which may indicate an inability to manage the credit you already have. It’s important to keep an eye on your credit history in order to maintain good credit and avoid any issues that might come up due to having a low FICO score.

If you’re not sure what your credit score is, you can check for free with a number of online tools

Knowing your credit score is important, as credit score ranges from 300 (poor credit) to 850 (excellent credit). A FICO credit score above 670 is typically considered a “good” credit score. Calculating credit scores has become incredibly specialized and now uses different models, such as FICO or VantageScore credit scoring models. Checking your credit score is now made infinitely simpler with the abundance of online tools that have become available. Credit card companies, lenders, and credit reporting agencies rely on these credit scores and credit score ranges when considering applications for credit cards, loans and other financial products. If you’re not sure what your current credit score is, then don’t worry – checking it for free with one of the many online tools is straightforward and won’t take more than a few minutes.

With the right knowledge and intentional effort, your credit score can be an incredible tool. By taking simple steps like making on-time payments, maintaining good credit history, keeping your balances low, proactively monitoring your credit reports and credit accounts, and using credit responsibly, you can develop good financial habits that will lead to a better FICO credit scores, saving you both time and money. On the other hand, if you’re not careful with how you use your credit score or don’t understand how it works, you could experience significant losses such as high interest rates and difficulty securing loans. So it is important to understand what makes up your credit score and how it impacts your finances. With proper understanding of the system, you can use your credit score to maximize your financial horizons.

How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023

How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023 How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023

How to Get Rid of Ability Recovery Services on Credit ReportDecember 14, 2023 How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023

How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023 How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023

How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023 How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023

How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023