Have you ever felt overwhelmed by the intricacies of repairing your credit? You’re not alone, and that’s why many people turn to credit repair companies for assistance. In this comprehensive guide, we’ll explore the top credit repair companies of 2024 and help you determine which one is right for you. Along the way, we’ll also provide insights into how credit repair companies work, factors to consider when choosing one, and the benefits of using a professional credit repair service. Buckle up and get ready to improve your financial future!

Short Summary

Research top credit repair companies of 2024 based on user reviews, dispute volume, services offered, and cost.

Consider the company’s standing, service guarantee, and customer reviews when selecting a credit repair company.

Understand the potential benefits of using a professional or DIY approach to improve financial health while avoiding scams.

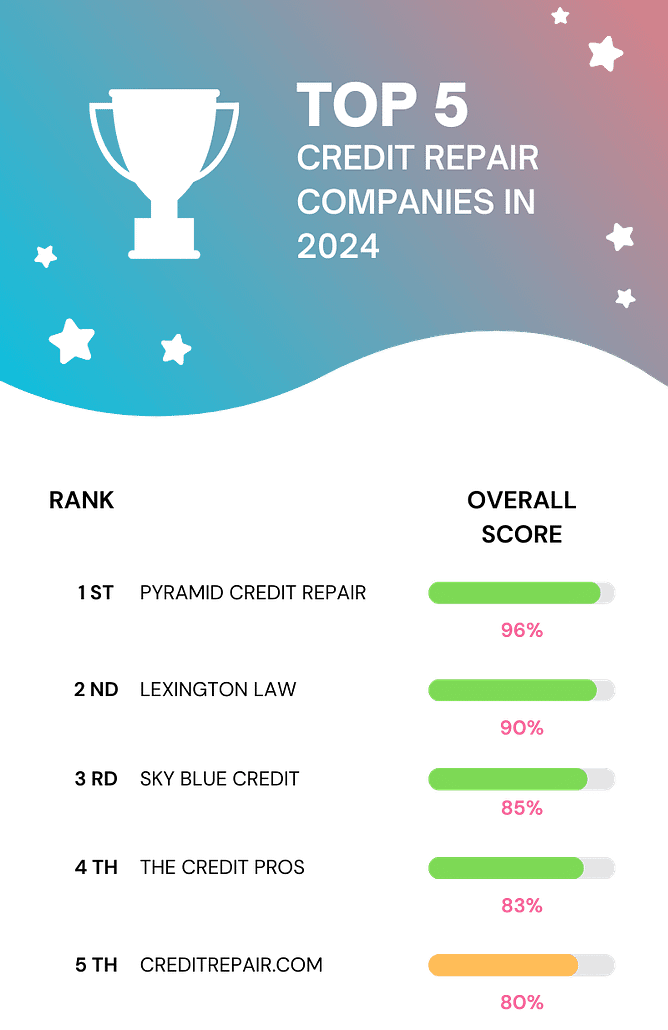

Top 10 Credit Repair Companies in 2024

Navigating the world of credit repair can be daunting, but we’ve done the legwork for you. Our list of the best credit repair companies is based on user reviews, monthly dispute volume, supplementary services available, cost, and warranty. To make it easier for you, we’ve identified the best credit repair company among the top 10 credit repair companies to help you make an informed decision.

These companies offer a wide range of services, from credit dispute and inquiry challenges to credit score analysis and identity theft protection. So, without further ado, let’s dive into the top 10 credit repair companies of 2024.

Pyramid Credit Repair

Established in the credit assistance industry for over a decade, Pyramid Credit Repair is known for its personalized services and a complimentary 15-minute Credit Consultation. They offer a spectrum of plans tailored to cater to various credit repair needs.

The Bronze plan, priced at $89 per month, is ideal for those new to credit repair or simply seeking a starting point. The Gold Plan, costing 9 per month, provides comprehensive services, including credit negotiation assistance, hard inquiry disputes, debt validation with creditors, and credit score tracking within the customer portal.

For those needing extensive credit guidance and a debt management strategy, the Platinum Plan at $179 per month provides credit coaching, and a debt consolidation/management plan.

Across all stages of the credit repair process, Pyramid Credit Repair offers unwavering support and guidance, ensuring clients have the necessary tools and resources to achieve their financial aspirations.

Lexington Law

As a highly-regarded credit repair law firm, Lexington Law provides an array of services across three tiers: Concord Standard, Concord Premier, and Premier Plus. We provide direct engagement with the three major credit bureaus to dispute any questionable items on your credit reports in every service level we offer. This will help you maintain your credit reports accuracy.

The Concord Premier package adds credit score analysis, TransUnion alerts, and access to an online dashboard. Their most comprehensive plan, Premier Plus, offers a FICO score tracker, identity theft protection, and personal finance tools.

With a proven track record of removing over 77 million items from their clients’ credit reports, Lexington Law’s expertise and familiarity with the credit industry make them a solid choice for anyone looking to improve their credit.

Sky Blue Credit

Sky Blue Credit offers excellent credit repair services at an affordable cost. They are known for their efficiency. Their approach includes credit report dispute services, personalized credit rebuilding tips, and coaching on how to build and maintain a good credit score. With a 35-day dispute cycle, Sky Blue Credit typically averages 15 items every 35 days, which is faster than some other top-rated credit repair companies.

Their pricing starts at $79 per month with no upfront fees for the first 6 days after opening an account. Couples can benefit from a 50% reduction on both the monthly fees and the setup fee. Additionally, Sky Blue Credit offers a 90-day money-back guarantee, providing peace of mind to clients as they embark on their credit repair journey.

The Credit Pros

The Credit Pros offers a range of services to suit individual needs, including customized credit advice, identity theft protection, and credit monitoring services. They provide three pricing options, with plans starting at $69 per month and an initial work fee of $119.

Their comprehensive service offerings and user-friendly client portal make The Credit Pros a reliable option for those looking to improve their credit.

CreditRepair.com

With years of experience in the credit repair industry, CreditRepair.com offers affordable plans, a user-friendly dashboard, and a range of educational resources to help clients improve their credit. Their success rate in removing over 8.2 million items from credit reports speaks to their expertise in the field.

CreditRepair.com, a credit repair agency, provides a comprehensive suite of services to help clients improve their credit score.

Credit Saint

Known for its aggressive credit repair approach, Credit Saint offers clear pricing, multiple membership packages, and a 90-day money-back guarantee. Their packages include Credit Polish, Credit Remodel, and Clean Slate, with prices ranging from $79.99 to $119.99 per month.

As a Credit Saint member, you will be able to log into a secure dashboard and keep an eye on your credit score. Additionally, any changes made to your report will be visible in real-time. With a complimentary consultation that includes a free credit score analysis and customized credit advice, Credit Saint is a highly regarded credit repair company in the industry.

Ovation Credit Services

Ovation Credit Services provides credit report dispute services, educational resources, and ongoing credit monitoring to help clients maintain a healthy credit profile. With a track record of successfully correcting over 120,000 credit profiles, Ovation Credit Services’ expertise in credit repair makes them a reliable choice for those seeking to improve their credit standing.

Their services are designed to help clients understand their credit reports, dispute inaccurate information, and build relationships.

How Credit Repair Companies Work

Credit repair companies analyze credit reports for errors, inaccuracies, and negative items that may be impacting credit scores. They submit disputes to the three credit bureaus to rectify or eliminate inaccurate data, ultimately improving the client’s credit score. By hiring a reputable credit repair company, clients can benefit from the company’s knowledge and experience in dealing with credit bureaus and creditors.

It’s important to be aware of the Credit Repair Organizations Act (CROA) when engaging with a credit repair company. This law mandates credit repair companies to present a written agreement that outlines their services and a copy of the “Consumer Credit File Rights Under State and Federal Law”. This helps protect consumers from fraudulent or exploitative practices.

Factors to Consider When Choosing a Credit Repair Company

When selecting a credit repair company, it’s crucial to consider the company’s standing, services provided, cost, and service guarantee, as most credit repair companies differ in these aspects. A high Better Business Bureau (BBB) rating indicates how well the company interacts with customers and the caliber of its service.

Before engaging with a credit repair company, thoroughly read the fine print of any money-back guarantees to ensure there are no stipulations or conditions that could impede the return of funds. Additionally, it’s important to assess customer reviews and any potential lawsuits against the company.

By taking these factors into account, you can make an informed decision and choose the right credit repair company to suit your needs.

Benefits of Using a Credit Repair Service

Hiring a credit repair company can save you time and effort by handling the process of disputing inaccuracies on your credit report. They can also provide valuable financial advice and tools to help you maintain a healthy credit profile. By enlisting the help of a credit repair company, you can avoid the stress and frustration of dealing with credit bureaus and creditors on your own.

Moreover, credit repair companies have the expertise and experience to identify and dispute errors more effectively than an individual. They are also familiar with the laws and regulations governing credit reporting, such as the Fair Credit Reporting Act (FCRA), which grants individuals the right to dispute any inaccurate information on their credit report.

As a result, hiring a credit repair company can lead to better outcomes in improving your credit score and overall financial health, compared to other credit repair companies.

DIY Credit Repair vs. Hiring a Professional

While it is possible to repair your credit on your own by reviewing your credit reports, disputing errors, and developing responsible financial habits, doing so can be a lengthy and complex process. It may also involve frequent communication with credit bureaus, which can be time-consuming and frustrating.

On the other hand, employing a credit repair company can provide superior outcomes and spare you the time and effort involved in tackling the process yourself. By enlisting the help of a professional, you can benefit from their expertise and familiarity with credit reporting laws, as well as their established relationships with credit bureaus and creditors.

Ultimately, the choice between DIY credit repair and hiring a professional depends on your personal circumstances, budget, and level of commitment to the process.

Understanding Credit Scores and Their Impact

Credit scores are a numerical representation of your creditworthiness, with higher scores indicating a lower risk for lenders. They are calculated based on factors such as payment history, amounts owed, length of credit history, new credit, and credit mix. Maintaining a good credit score is crucial for securing loans and favorable interest rates.

A poor credit score can result in loan denials or higher interest rates, which can significantly impact your financial future. By working with a credit repair company, you can improve your credit score by disputing inaccuracies and learning valuable financial habits to maintain a healthy credit profile. This, in turn, can help you secure better loan terms and save money in the long run.

Avoiding Credit Repair Scams

It’s crucial to be vigilant when engaging with a legitimate credit repair company, as not all credit repair companies are trustworthy. Some red flags to watch out for include companies demanding payment upfront, making unrealistic promises, or refusing to provide a written contract outlining their services.

To avoid falling victim to a credit repair scam, research the company’s reputation by checking their BBB rating, reading customer reviews, and consulting the Consumer Financial Protection Bureau’s complaint database.

Remember that you have the right to dispute any inaccurate information on your credit report for free under the Fair Credit Reporting Act (FCRA), so be cautious of companies charging excessive fees for this service.

Credit Repair and Identity Theft

Victims of identity theft often experience significant damage to their credit scores due to fraudulent accounts and transactions. In these cases, credit repair companies can provide valuable assistance by disputing fraudulent accounts and guiding clients on prevention measures. Engaging with a credit repair company can help victims of identity theft restore their credit and regain financial stability.

In addition to disputing fraudulent charges, credit repair companies can also provide ongoing credit monitoring and identity theft protection services to help safeguard your financial information and prevent future instances of identity theft. By taking proactive measures to protect your credit and address any instances of identity theft, you can maintain a healthy credit profile and enjoy greater peace of mind.

The Cost of Credit Repair Services

The cost of credit repair services typically includes a setup fee, also known as the initial or first work fee, and a monthly subscription fee. Credit repair companies charge fees that can vary widely depending on the company and the services provided, ranging from $50 to $150 per month. To accurately compare the total cost of several credit repair agencies, it’s helpful to multiply the monthly fee by three and add the first-work fee.

While the cost of credit repair services may seem daunting, it’s essential to weigh the potential benefits against the expense. A higher credit score can lead to better loan terms in the long-run and lower interest rates, ultimately saving you money. By investing in professional credit repair services, you’re investing in your financial future.

The Duration of the Credit Repair Process

The duration of the credit repair process depends on the extent of the situation and the number of errors and inaccuracies in your credit report. On average, most credit repair cases take around 3-6 months to fully resolve. So it is necessary to be patient while the process takes place. However, the process may be shorter or longer depending on the specific circumstances and the credit repair company you choose.

Keep in mind that while some credit repair companies may promise quick results, it’s important to be realistic about the timeline and set reasonable expectations. Patience and persistence are key when it comes to improving your credit score, and working with a reputable credit repair company can help ensure you achieve the best possible outcome.

Summary

In conclusion, choosing the right credit repair company can be a game-changer in improving your credit score and securing a brighter financial future. By carefully evaluating the reputation, services, pricing, and guarantees of various companies, you can find the best fit for your unique needs. Remember that investing in credit repair is an investment in your financial future, and with the right guidance and support, you can achieve lasting improvements in your credit profile.

Frequently Asked Questions

Is it worth paying someone to fix your credit?

Paying someone to fix your credit is typically not worth it, since the most common way these companies work is to dispute all negative items on your report, regardless of accuracy. This means that even if the negative items are accurate, they will still be disputed, which can lead to a temporary boost in your credit score, but it won’t last.

How fast can a credit repair company work?

Credit repair companies typically take three to six months to work, with your credit score gradually improving as creditors agree to make changes in your favor.

This process can be time-consuming, but it is worth it in the end. With the help of a credit repair company, you can improve your credit score and get back on track with your finances.

What services do credit repair companies typically offer?

Credit repair companies offer services such as credit dispute, inquiry challenges, credit score analysis, identity theft protection, and credit monitoring to help improve a consumer’s credit score.

These services can help consumers repair their credit and improve their credit score. They can also help protect consumers from identity theft and monitor their credit score for any changes.

By using these services, consumers can take control of their credit and make sure that their credit is safe.

How long does the credit repair process usually take?

The credit repair process usually takes around three to six months.

Can I repair my credit on my own, or do I need to hire a professional?

It is possible to repair your credit on your own, but a professional credit repair company can offer superior results and save you time.

With the help of a credit repair company, you can get your credit score back on track quickly and efficiently. They can help you identify errors on your credit report, negotiate with creditors, and dispute any inaccurate information.

How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023

How to Remove Hard Inquiries from Your Credit Report in 15 MinutesOctober 10, 2023 How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023

How to Handle Credit Collection Services (CCS) on Your Credit ReportOctober 24, 2023 Get Approved: Credit Score Needed For AffirmOctober 24, 2023

Get Approved: Credit Score Needed For AffirmOctober 24, 2023 How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023

How to Handle Transworld Systems (TSI) on Your Credit ReportDecember 6, 2023 How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023

How to Cancel Your Credit One Card: A Step-by-Step GuideNovember 28, 2023